The Rapid Expansion of Crypto Spot ETFs: Market Momentum and Regulatory Shifts

The Market Accelerates: A Surge of New Spot ETF Listings

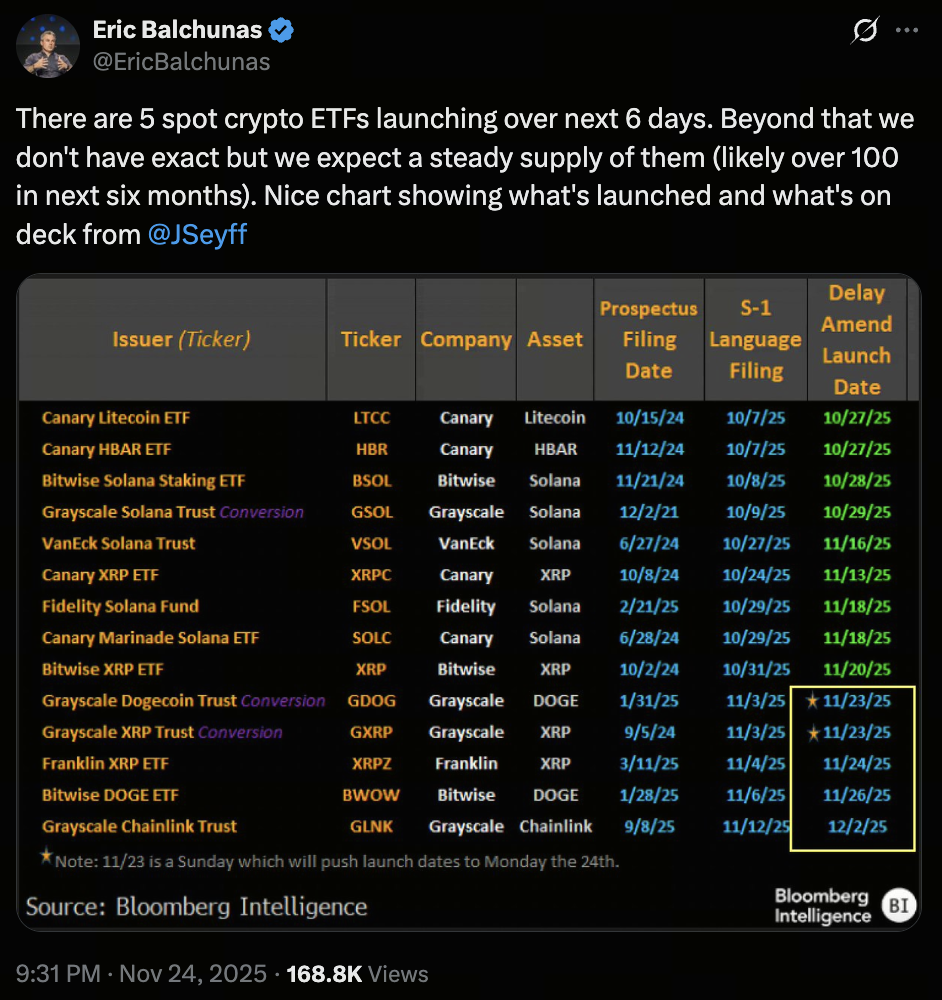

The rollout of crypto spot ETFs has entered a new phase of momentum, with analysts noting an unusually fast pace of product launches. Bloomberg’s Eric Balchunas highlighted that several new spot ETFs—beyond Grayscale’s GDOG—are expected to debut soon, including those tied to XRP, Chainlink, and Dogecoin. Issuers such as Franklin Templeton, Bitwise, and Grayscale are actively preparing their offerings, signaling growing institutional interest. Based on current review speeds and market demand, projections suggest that more than one hundred crypto-related ETFs could enter the market within the next six months, marking an unprecedented period of expansion.

(Image source: Eric Balchunas)

Regulatory Shifts: The Catalyst Behind the ETF Boom

The acceleration in approvals can be traced largely to changes in regulatory posture. The SEC, once highly cautious with non-BTC and non-ETH digital assets, has begun focusing less on whether these products should exist and more on how they should operate within a supervised framework. This marks a significant departure from earlier periods, when products such as Bitwise’s index funds faced delays or temporary halts during review.

To meet evolving expectations, issuers are adopting clearer fee structures and stronger risk controls. Franklin Templeton’s XRP ETF (XRPZ), for example, offers a 0.19% annual fee and a temporary fee waiver to boost transparency—features that help reduce concerns around manipulation and operational clarity.

A Broader Mix of Assets: What the Latest ETF Choices Signal

The range of tokens selected for new ETFs reflects a growing sophistication among regulators and issuers regarding the role different digital assets play in the ecosystem. Rather than focusing solely on store-of-value narratives, the market is beginning to recognize the relevance of infrastructure and utility-driven tokens.

LINK: Infrastructure Value Recognized

Chainlink’s inclusion underscores the increasing acknowledgment of tokens that provide essential blockchain infrastructure. As a dominant oracle network, LINK represents a category of assets with practical, ecosystem-wide demand—making it a logical addition for issuers shaping diversified ETF offerings.

XRP: Legal Clarity and Payment Utility

Progress in the SEC–Ripple case has brought improved regulatory clarity to XRP, paired with its established presence in cross-border payment solutions. These factors positioned XRP as one of the first non-BTC and non-ETH assets to move toward ETF eligibility.

DOGE: The Power of Community and Cultural Influence

Dogecoin, despite its less technical narrative, remains a market force thanks to its massive community and ongoing public endorsements by influential figures. Its strong demand profile makes it a practical inclusion for issuers responding to investor interest.

Together, these examples illustrate a shift in ETF selection—from prioritizing the most conservative assets to focusing on those with strong real-world traction or community-driven relevance.

Potential Risks in a Wave of Rapid Listings

While the sudden influx of ETF products signals a maturing market, it also brings potential challenges. A large cluster of simultaneous launches can dilute capital allocation, leaving individual ETFs with limited scale. Thinly traded products may then face liquidity concerns, reducing their effectiveness for investors.

Additionally, multi-asset index ETFs continue to undergo more rigorous regulatory review. Products like the Bitwise 10 remain under detailed examination, as the SEC requires higher levels of transparency and data disclosure for diversified crypto baskets.

Therefore, although the growing number of listings captures attention, long-term success will depend on each ETF’s ability to maintain efficient trading, attract consistent inflows, and ensure stable liquidity.

Conclusion

The rapid emergence of crypto spot ETFs reflects not only a softening regulatory stance but also increasing recognition of the asset class within mainstream finance. With the inclusion of functional tokens, community-driven assets, and diverse investment strategies, the market is moving toward deeper integration between traditional finance and the digital economy. Ultimately, the endurance of these ETFs will hinge on the strength of their underlying assets and the operational capabilities of their issuers. The coming year will serve as an important test for whether these new products can establish meaningful, lasting influence in the maturing crypto financial ecosystem.

Disclaimer:

This is not investment advice. This information is provided for informational purposes only and should not be construed as a recommendation to buy, sell, or hold any asset. Cryptocurrency trading involves a risk of loss. Gate US services may be restricted in certain jurisdictions. For more information, please see our legal disclosures: https://us.gate.com/legal/disclosures

Related Articles

Bitcoin Halving Chart: Key Dates, Trends, and Future Predictions

Bitcoin Halving Chart:Understanding the Changes in Bitcoin Supply and Price Trends

US December Rate Cut Forecast: Will the Federal Reserve Finally Pivot?

Federal Reserve Ends Quantitative Tightening — How the End of QT Could Reshape Global Markets in 2025

Midnight Network Ignites Cardano’s Next Chapter with NIGHT Token Mining and Privacy Innovation