Gate Research: PYTH Surges Over 83% in 24 Hours | Circle Joins $5 Trillion Cross-Border Payment Network

Crypto Market Overview

BTC (-1.81% | Current Price: 110,982 USDT)

Recently, BTC faced resistance at the $113,200 high and has since entered a continuous pullback, forming a clear downward channel. The current price is hovering around $111,500, consolidating at a low level for several hours. From the moving averages perspective, short-term MAs (MA5, MA10) have repeatedly crossed below MA30, showing that bears still dominate. Notably, BTC formed a temporary low near $111,100 and rebounded slightly, suggesting some support strength in this area.

If BTC can hold above the $111,000–112,000 range, a short-term rebound toward the $113,500–114,000 resistance area may be expected. Conversely, if it falls below the key $111,000 level, it may retest the previous low support at $110,500. Overall, BTC remains in a weak consolidation trend. Investors are advised to closely monitor changes in trading volume and whether key support holds to judge the future balance between bulls and bears.

Additionally, on August 28, BTC ETFs saw a net daily inflow of $81.4 million, with BlackRock’s IBIT accounting for $50.9 million and Fidelity’s FBTC contributing $14.7 million.

ETH (-2.58% | Current Price: 4,454 USDT)

Recently, ETH encountered resistance at $4,620 and entered a sustained pullback, showing a downward channel. The price is currently around $4,450, repeatedly testing lows during the day and remaining weak. In terms of moving averages, short-term MAs (MA5, MA10) have clearly crossed below MA30, indicating the bearish trend continues. Notably, ETH established a temporary low around $4,420 and rebounded slightly, showing some support strength in this region.

If ETH can hold above the $4,440–4,480 range, it may see a short-term recovery toward the $4,550 resistance level. Conversely, if it breaks below the key $4,400 level, it could retest the previous low support at $4,350–4,320. Overall, ETH remains in a weak consolidation trend. Investors should watch trading volume changes and whether the $4,400 support level holds to assess future market direction.

On August 28, ETH ETFs recorded a net daily inflow of $39.1 million, with BlackRock’s ETHA seeing an inflow of $67.6 million, while Fidelity’s FETH saw an outflow of $33.5 million.

GT (+0.01% | Current Price: 16.97 USDT)

GT retreated after encountering resistance at $17.40 and is now trading near $16.90. Since the recent high, the price has seen a significant decline but found support around $16.80, entering a low-level consolidation phase.

From the moving averages perspective, short-term MAs (MA5, MA10, MA30) are forming resistance below $17. Price has attempted to break above these levels several times but lacked momentum, indicating weak bullish strength and that the market remains in a fragile recovery state. Trading volume expanded during the decline but has since contracted within the $16.8–17.2 range, suggesting selling pressure is easing but buying interest remains limited.

Looking ahead, if GT can hold above $16.8 and break through the $17.5 resistance with increased volume, a rebound toward $18.2–18.8 may follow. Conversely, a breakdown below $16.8 could accelerate the decline toward $16.3 or lower. Overall, GT is in a low-level consolidation phase, with short-term investor sentiment leaning toward caution. Focus should be on whether $16.8 support holds and whether trading volume expands effectively.

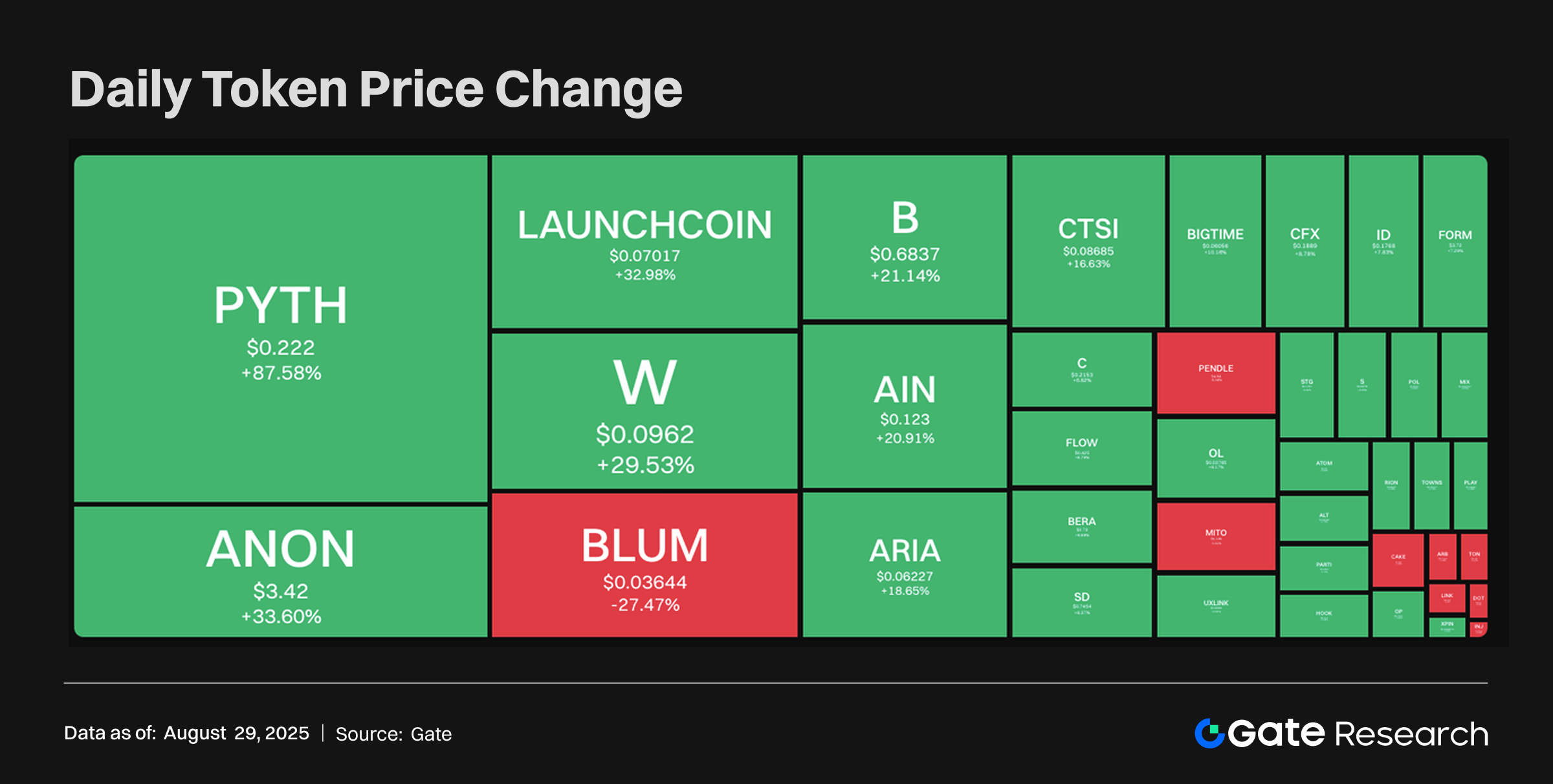

Tokens Heatmap

Overall market sentiment remains positive, with a few tokens such as PYTH, ANON, and LAUNCHCOIN posting gains of over 30%, emerging as the leading sector and reflecting concentrated capital inflows and strong bullish momentum. In contrast, BLIUM recorded a sharp decline of -27.47%, making it the biggest loser of the day, likely linked to project developments, market selling pressure, or potential negative news.

PYTH – Pyth Network (+83.55%, Market Cap $1.194B)

According to Gate data, PYTH is currently priced at $0.21, up 83.55% in 24 hours. Pyth Network is an oracle that delivers financial market data to multiple blockchains, and PYTH is its governance token. Michael Cahill, CEO of Douro Labs (Pyth’s development company), previously worked on special projects at Jump Crypto.

The surge in PYTH was mainly driven by news of a collaboration between the U.S. Department of Commerce, Chainlink, and Pyth Network. This partnership brings official macroeconomic data on-chain for the first time, including GDP, PCE Price Index, and Real Final Sales. This enables DeFi platforms and blockchain apps to access verified government data in real time, supporting lending rate adjustments, collateral requirements, and new financial products such as inflation-linked assets. Multiple major chains, including Ethereum, Avalanche, Arbitrum, and Optimism, will distribute this data, improving transparency and verifiability. The market views this as a key step toward integrating traditional finance with DeFi, boosting demand and price for PYTH.

W – Wormhole (+36.74%, Market Cap $488M)

According to Gate data, W is trading at $0.10, up 36.74% in 24 hours. W is the native token of Wormhole, available as both a Solana SPL and Ethereum ERC20 token, transferable across all networks connected to Wormhole.

The recent surge is linked to market sentiment around the StarGate acquisition event. Although LayerZero ultimately acquired StarGate for $110M, Wormhole’s higher bid was interpreted by investors as a sign of its financial strength and expansion ambitions. The bidding war also drew renewed attention to the cross-chain ecosystem and Wormhole’s potential role, driving short-term trading interest.

TREE – Treehouse (+21.02%, Market Cap $58.42M)

According to Gate data, TREE is trading at $0.37, up 21.02% in 24 hours. Backed by top investors such as Wintermute, GSR, GFC, and Lightspeed, Treehouse offers two core modules:

- tAssets – aggregates fragmented on-chain rates to create yield premiums for Liquid Staking Tokens (LSTs).

- DOR – a decentralized consensus mechanism that builds a LIBOR-like crypto system, using base rates to assess forecasting accuracy and structure term rates for crypto assets.

TREE’s recent rally is supported by improved market sentiment and ecosystem development. Previously, TREE dropped sharply after its July airdrop due to investor selling, but interest has since rebounded. Additionally, Conflux Network announced a strategic partnership with AIOZ Network to integrate decentralized infrastructure services, including AI marketplaces, media streaming, object storage, and IPFS pinning, adding utility and long-term value to the TREE ecosystem.

Daily Token Launch

New Token Sale Details

- Subscription Project: SecondLive

- Token Name: LIVE

- Subscription Period: September 4, 2025, 10:00 (UTC)

- Participation Method: Stake USDT or LIVE to claim for free

- Total Airdrop Supply: 200,000 LIVE

Project Introduction

SecondLive pioneered the first AI-powered, self-evolving digital universe, integrating AI agents, AIGC tools, and blockchain technology to empower users, brands, and developers in creating immersive spaces and virtual avatars. With tools such as Gobetti and Calzone, combined with a dual-token economic system, the platform has attracted 4.7M users and strong backing from top investment institutions. Bridging Web2 creativity and Web3 intelligence, SecondLive continues expanding into entertainment, education, and simulation fields.

Hotpot Insights

Finastra partners with Circle to integrate USDC into $5T global payments network

London-based fintech firm Finastra announced a partnership with Circle to integrate USDC stablecoin into its core payment platform, Global PAYplus (GPP), which processes over $5 trillion in daily cross-border payments. This integration allows banks to settle cross-border transfers in USDC, reducing reliance on traditional correspondent banking networks known for high costs and slow settlement. USDC enables faster and cheaper clearing, significantly improving liquidity efficiency and cross-border payment experiences.

This move strengthens stablecoin adoption in traditional finance and shows growing institutional interest in blockchain settlement models. With PayPal, Stripe, and other payment giants investing in stablecoin infrastructure, Circle’s USDC (the second-largest stablecoin with a $69B supply) is gaining mainstream traction. Experts believe this partnership could accelerate financial institutions’ digital transformation and innovation.

Bitcoin mining costs continue rising, pushing miners toward diversification

Bitcoin mining faces unprecedented challenges. At the SALT conference, Cleanspark and Terawulf executives noted that electricity costs account for about half the cost of mining a single BTC, further squeezing profitability. With ETFs and AI infrastructure demand increasing, miners must diversify, for example via energy monetization strategies, to cope with market pressures beyond halving cycles.

Meanwhile, Bitcoin’s ecosystem is innovating in technology and finance. Lombard Finance launched LBTC (a liquid staking token for Bitcoin) for multi-chain DeFi use. Optimism partnered with Flashbots to enhance OP Stack transaction sequencing and throughput. Hemi Labs raised $15M to develop the Bitcoin programmable network and hVM, supporting lending and trading apps. These moves highlight how Bitcoin is evolving into a composable, productive asset ecosystem despite mining challenges.

Luxxfolio plans $73M fundraising, shifts to Litecoin reserve strategy

Canadian crypto infrastructure firm Luxxfolio is pivoting from BTC mining to a Litecoin-based reserve strategy, while expanding related infrastructure. On Thursday, the company filed a CAD 100M ($73M) shelf prospectus, enabling fundraising via stock, debt, or other securities over 25 months. CEO Tomek Antoniak described Litecoin as “hard money” and outlined plans to accumulate 1M LTC by 2026. Litecoin founder Charlie Lee joined the advisory board in June.

However, Luxxfolio faces serious financial stress. Q2 saw zero revenue and a net loss of $197K (vs. $8K last year), with only $112K in cash left. Since 2017, cumulative losses have reached nearly $19M. The firm recently relied on a $844K private placement to stay afloat. Analysts warn that while institutional interest in crypto reserves is growing, Luxxfolio’s liquidity shortage and mounting losses make the strategy risky if LTC is merely hoarded without productive use.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/crypto-market-data

- Investing, https://investing.com/indices/usa-indices

- Investing, https://investing.com/currencies/xau-usd

- Gate, https://www.gate.com/price/camp-network-camp

- Gate, https://www.gate.com/trade/VVS_USDT

- Gate, https://www.gate.com/trade/LPT_USDT

- Coindesk, https://www.coindesk.com/business/2025/08/27/finastra-taps-circle-to-bring-usdc-settlement-to-usd5t-global-cross-border-payments

- Coindesk, https://www.coindesk.com/tech/2025/08/27/the-protocol-bitcoin-mining-faces-new-challenges-as-power-costs-eat-profit

- Decrypt, https://decrypt.co/337295/luxxfolio-files-73m-litecoin-treasury-plans

- Gate, https://www.gate.com/launchpool/LIVE?pid=364

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review