Gate Research: BIO and LINK Surge | Japan to Approve First Yen Stablecoin JPYC

Crypto Market Overview

BTC (-1.52% | Current Price: 115,804 USDT)

BTC previously surged to a short-term high of 124,497 USDT but failed to break through and subsequently retraced with increased selling pressure. On the moving average system, short-term MA5 and MA10 have crossed below MA30, forming a bearish alignment and indicating short-term weakness. The price has repeatedly found support around 115,800 USDT, but it is now approaching this critical level. A break below could see further declines toward 114,000 USDT or lower. Conversely, a rebound requires first reclaiming the short-term resistance near 117,300 USDT to reverse the weak trend.

Volume analysis shows significant spikes during declines, reflecting strong selling pressure and a bearish market sentiment. Overall, the key short-term focus is the 115,800 USDT support; if it fails, further downside is likely, while holding this level could trigger a technical rebound.

Additionally, on August 15, BTC ETFs saw a net outflow of 14.1 million USD, while BlackRock IBIT inflows reached 146 million USD.

ETH (-0.73% | Current Price: 4,358 USDT)

ETH recently pulled back sharply after reaching a high of 4,575 USDT and is now trading around 4,360 USDT, with an intraday low of 4,342 USDT. The short-term MA5 and MA10 have quickly crossed below MA30, forming a clear bearish alignment, signaling short-term weakness. Volume during the decline was elevated, indicating strong bearish momentum and selling pressure. Key support is at 4,340 USDT; a break below could lead to further retracement toward 4,300 USDT or lower.

On the upside, a stabilization above the current area and reclaiming 4,400 USDT could trigger a short-term rebound, though resistance around 4,460 USDT (near MA30) remains significant. Overall, ETH remains bearish in the short term, with attention focused on critical support levels.

On August 15, ETH ETFs saw a net outflow of 59.3 million USD, with BlackRock ETHA inflows of 338 million USD and Fidelity FETH outflows of 272 million USD.

GT (-0.19% | Current Price: 17.51 USDT)

GT has recently been consolidating within a range of 17.0–18.5 USDT, showing no clear directional trend. The price is currently around 17.5 USDT, with short-term MA5 and MA10 turning downward and crossing below MA30, signaling weak short-term momentum.

Volume remains generally low, with only occasional spikes, indicating limited market participation. Support at the 17.0 USDT level is crucial; a breach could accelerate declines toward 16.8 USDT. On the upside, resistance is concentrated around 17.8–18.0 USDT; a successful breakout and stabilization could open the way to challenge the 18.5 USDT high. Overall, GT is in a narrow consolidation range, leaning weak in the short term, with 17.0 USDT as the key support to monitor.

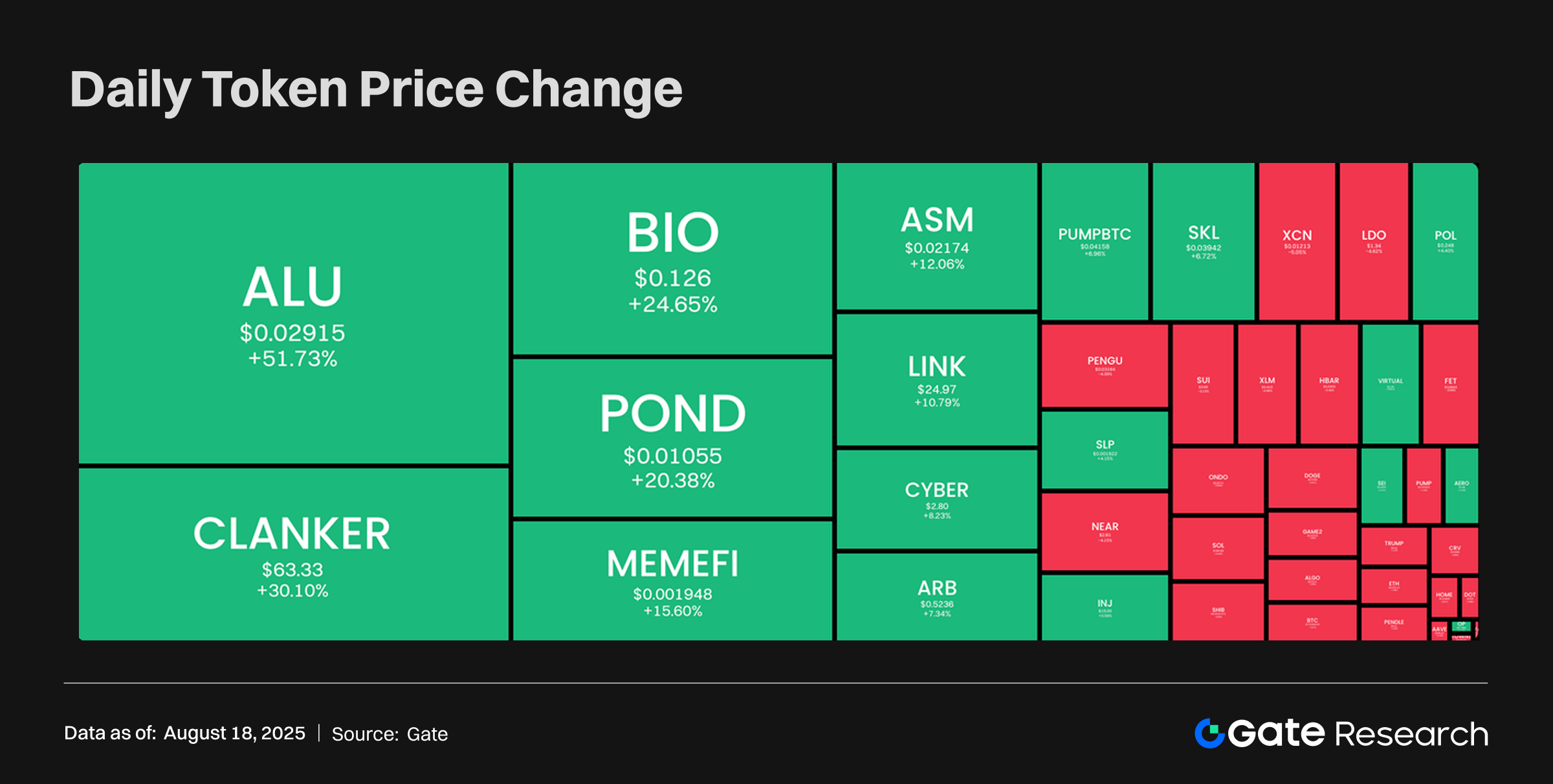

Tokens Heatmap

Although the market has seen some pullback, most altcoins still recorded significant gains. ALU led the pack with a remarkable 51.73% increase, attracting strong market interest. CLANKER also performed impressively, rising 30.10%. Other notable tokens with double-digit gains included BIO (+24.85%), POND (+20.38%), MEMEFI (+15.60%), and LINK (+10.79%). However, certain tokens such as PENGU, SUI, and ETH faced some corrective pressure or specific negative factors.

BIO – Bio Protocol (+24.65%, Market Cap: $203M)

According to Gate data, BIO is currently priced at $0.126, up 24.65% over 24 hours. BIO is a decentralized science (DeSci) governance and liquidity protocol. Its mission is to accelerate biotechnology development by enabling global patients, scientists, and biotech professionals to collectively fund, establish, and own tokenized biotech projects and intellectual property (IP).

Recently, BIO launched a bio marketplace with real-time DeSci analysis and BioAgent trading, enriching its ecosystem applications. The project also announced that over 125 million BIO have been staked and introduced a 1 million BioXP incentive plan. Additionally, a new points system was launched, offering free BioXP to OG users as a reward for long-term support. These technological innovations, combined with token staking and community incentives, have contributed to BIO’s strong price surge.

LINK – Chainlink (+10.79%, Market Cap: $16.849B)

According to Gate data, LINK is currently trading at $24.97, up 10.79% in 24 hours. Chainlink is a decentralized oracle network that securely connects blockchain smart contracts with off-chain real-world data, including financial market feeds, weather information, and IoT data. LINK tokens are used to reward node operators and pay developers for services.

Recently, Chainlink launched the Chainlink Reserve strategic plan, converting enterprise user fees and on-chain revenue into LINK to support long-term network sustainability. Chainlink also announced a strategic partnership with ICE, the parent company of the New York Stock Exchange, strengthening its bridge role between traditional finance and blockchain. On-chain data shows that whales accumulated 580,000 LINK (over $13.8M) across four addresses in 24 hours. Both fundamental and capital factors have driven LINK’s strong upward momentum.

ARB – Arbitrum (+7.34%, Market Cap: $2.66B)

According to Gate data, ARB is trading at $0.5236, up 7.34% over 24 hours. ARB is the governance token for the Arbitrum network, a Layer 2 Ethereum scaling solution developed by Offchain Labs, designed to increase transaction speed and reduce costs while remaining compatible with Ethereum. ARB is primarily used for Arbitrum DAO governance, including proposals, voting, and fund allocation.

ARB’s recent strong performance is supported by multiple factors. Robinhood has launched Arbitrum, opening a DeFi gateway for millions of TradFi users. PayPal also announced adoption of the Arbitrum network, boosting confidence in its ecosystem. Additionally, Arbitrum DAO, one of the first organizations to join Ethereum’s strategic reserves, saw its ETH treasury grow by roughly 36% in a month, reflecting robust capital expansion and providing long-term support for ARB’s price. Technically, ARB successfully broke through a key resistance zone after months of consolidation, entering a new upward cycle and lifting overall market sentiment.

Daily Token Launch

New Token Sale Details

Project: PublicAI

Token: PUBLIC

Subscription Deadline: August 22, 2025, 8:00 (UTC)

Participation Method: Stake ETH or PUBLIC to claim for free

Total Airdrop: 1,750,000 PUBLIC

Project Introduction

PublicAI aims to advance the AI ecosystem by providing high-quality, on-demand AI training data. The platform not only meets enterprises’ urgent demand for quality data but also allows individuals worldwide to monetize their expertise.

Hotpot Insights

NFT Market Activity Surges 30% Over Past Week

According to CryptoSlam, in the seven days ending August 17, NFT market trading volume rose 30% week-over-week to $173.2 million. Active buyers surged 190.41% to 214,716, and sellers increased 168.71% to 115,289, while transaction counts slightly decreased 10.65% to 1,553,949. By network:

- Ethereum NFT volume led at $105.4M, up 85% YoY

- BNB Chain at $18.1M, up 33.48%

- Solana at $8.9M, up 10.14%

- Polygon and Mythos Chain fell 35.51% and 3.52% to $11.5M and $9.3M, respectively

The NFT market shows clear signs of recovery, with participation from both buyers and sellers rising sharply, indicating renewed interest in digital assets. Ethereum remains dominant, while BNB Chain and Solana show strong activity, highlighting the appeal of a multi-chain ecosystem. However, declining transaction counts suggest that activity may be concentrated in high-value or popular NFTs. Overall, short-term growth momentum is strong, but attention should be paid to volatility and sustainability of investor sentiment.

Japan to Approve First Yen-Backed Stablecoin JPYC

Nikkei reports that Japan’s Financial Services Agency plans to approve the country’s first yen-pegged stablecoin, JPYC, this month. Fintech company JPYC Inc. will be registered as a remittance service provider, with sales expected to begin a few weeks after registration. JPYC will be backed by liquidity assets such as government bonds to maintain a stable peg of 1 JPYC = 1 JPY.

The launch marks a major step in Japan’s digital currency regulation. As the first yen-backed stablecoin, JPYC provides a convenient and secure digital option for domestic payments and cross-border remittances, potentially increasing Japan’s influence in the Asian stablecoin ecosystem. For the market, it reflects the traditional financial sector’s willingness to embrace crypto while emphasizing compliance and asset-backed stability, helping build trust among both public and institutional participants.

Arbitrum DAO ETH Treasury Rises 36% to 22,500 ETH

Arbitrum DAO, one of the earliest organizations to join Ethereum’s strategic reserve, grew its ETH treasury by approximately 36% over the past month, now holding 22,500 ETH, valued near $100 million, about 0.02% of total ETH supply. The overall treasury portfolio increased to around $80 million, driven by ETH price appreciation and stablecoin inflows into risk assets (RWA). July 2025 data indicate that Arbitrum DAO’s fund management strategy remains robust amidst market volatility, balancing yield growth with risk management.

The treasury growth highlights Arbitrum DAO’s proactive ETH strategy and reflects a trend toward institutional-style asset management within DeFi organizations. By combining stablecoins with RWA inflows, the DAO maintains liquidity while boosting returns, showcasing the potential of diversified crypto asset management. For investors, this prudent treasury approach enhances confidence in Arbitrum’s long-term ecosystem development and underscores DeFi projects’ ongoing improvement of financial governance.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/trade/GT_USDT

- Gate, https://www.gate.com/price

- Gate, https://www.gate.com/launchpool/PUBLIC?pid=357

- Crypto.news, https://crypto.news/nft-sales-bored-ape-yacht-club-sales-jump-499/

- X, https://x.com/EntropyAdvisors/status/1956075867630919935

- jin10, https://flash.jin10.com/detail/20250817175753508800

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review