Gate Research: Global Crypto Market Cap Hits Record $4.21 Trillion | Ethereum Search Interest Hits Highest Since 2021

Crypto Market Overview

BTC ( +3.53% | Current Price: 123,502 USDT)

After securing solid support around $122,000, BTC gradually moved upward in a choppy pattern and broke above $124,400 on August 14, setting a new all-time high. Short-term moving averages remain in a bullish alignment, while the MACD’s red bars continue to expand, indicating strengthening bullish sentiment and capital momentum. Structurally, the breakout above $124,400 not only breached the upper bound of the previous consolidation range but was also accompanied by rising volume, confirming the validity of the upward breakout. If BTC can consolidate steadily above the breakout level, it may next target $125,000–$125,500. Conversely, if volume declines or resistance emerges, a pullback toward $123,000 could serve as a support retest before attempting another rally.

ETH (+3.31% 丨 Current Price: 4,730 USDT)

ETH continues to trend upward in a choppy manner, currently trading above $4,700, with moving averages showing a bullish divergence and technical structure remaining strong. While the MACD shows signs of retreat, the shortening green bars suggest momentum loss is easing, potentially allowing strength to rebuild. In the short term, watch the $4,600–$4,700 support area; holding this level could set the stage for another test of the $4,780 resistance.

GT (+6.51% 丨 Current Price: 17.815 USDT)

GT pulled back after reaching $21.93 and is now consolidating sideways near $17.8. Moving averages are converging, and the MACD remains below the zero line, indicating weak momentum. In the near term, price action may continue oscillating within the $17.5–$18 range. A significant volume increase and a breakout above the MA10 could signal a rebound; otherwise, a drop below $17.5 would raise the risk of a decline toward the $16.3 support.

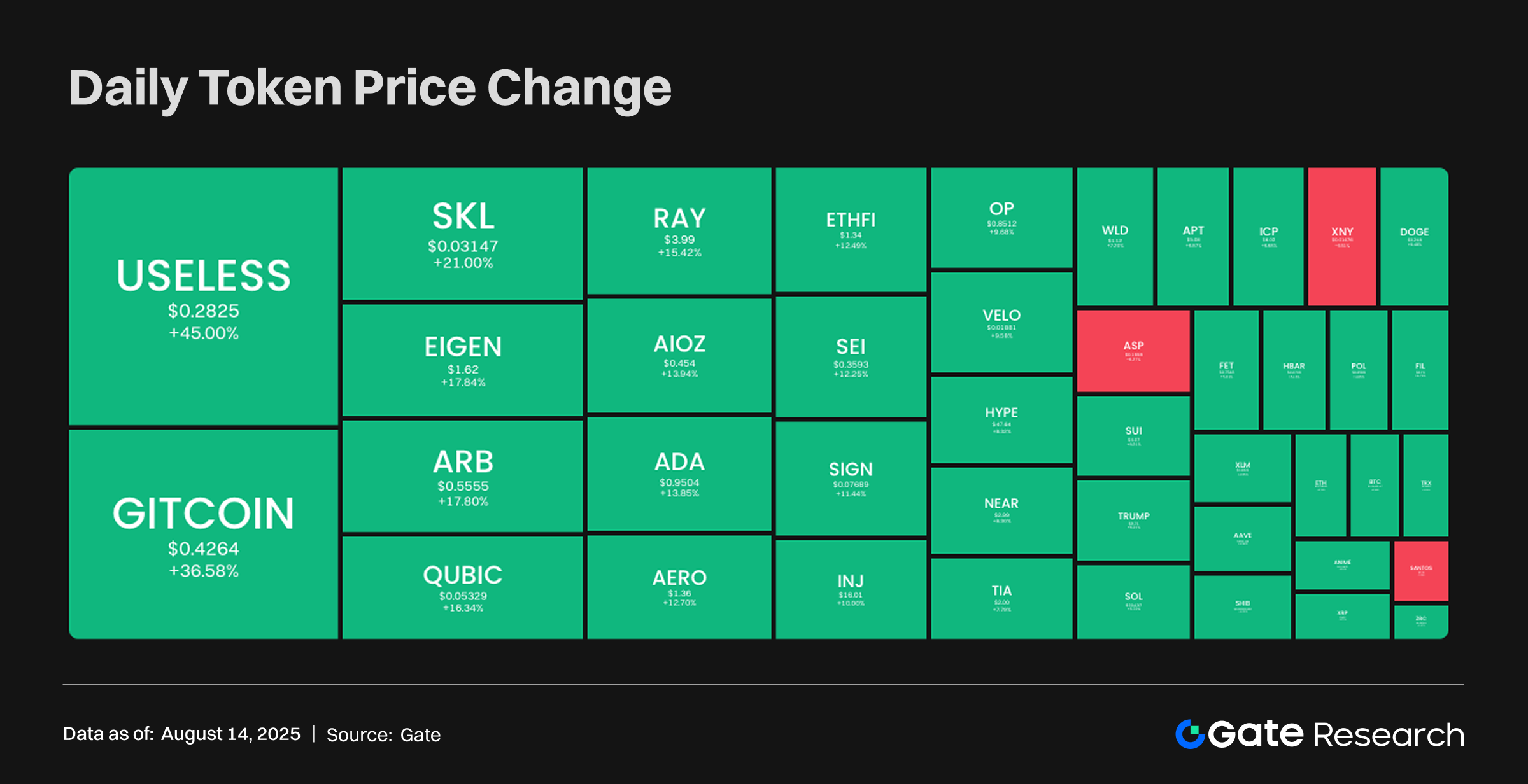

Tokens Heatmap

Most tokens continued their strong upward momentum, with market sentiment running high and capital activity significantly increasing. Among them, USELESS surged by 45.00%, becoming the clear leader; GITCOIN rose 36.58%, while SKL, EIGEN, ARB, and QUBIC each gained more than 16%, all drawing considerable investor attention. In contrast, XNY fell 5.87% and ASP dropped 4.21%, both clearly underperforming the broader market and ranking among the few tokens that pulled back against the trend.

USELESS – Useless Coin (+45%, Circulating Market Cap: $275M)

According to Gate market data, USELESS is currently trading at $0.2825, up roughly 45% in the past 24 hours. Useless Coin is a meme token on Solana built around the reverse narrative of “uselessness as value.” Leveraging humor and irony, it creates brand influence, emphasizing the role of community culture and meme virality in shaping the value of crypto assets.

Recently, the project announced its inclusion in multiple exchanges’ asset listing schedules, with deposit and trading gradually opening. At the same time, social media buzz has kept rising, fueling user discussions and visibility. These factors have combined to boost the token’s market exposure and trading activity, drawing in large amounts of capital and new users. With both exchange listings and community sentiment driving it, trading volume has surged alongside a notable strengthening of bullish momentum.

EIGEN – Eigenlayer (+17.84%, Circulating Market Cap: $514M)

According to Gate market data, EIGEN is currently priced at $1.62, up 17.84% over the past 24 hours. Eigenlayer is an Ethereum restaking protocol that uses Verifiable Cloud and the EIGEN token to provide verifiable, executable cross-chain security and trust for multi-chain ecosystems. It allows users to restake ETH or derivative assets to secure on-chain services and applications.

Recently, the project announced that the total value of ETH and EIGEN supported by its Verifiable Cloud has exceeded $23 billion, a record high. It also partnered with Canary Protocol to integrate DVN (Distributed Validation Network) with a redistribution mechanism, creating a new model for cross-chain security and cryptoeconomic accountability. These developments have likely increased market recognition of Eigenlayer, while heightened community and industry activity have further boosted sentiment.

ARB – Arbitrum (+17.80%, Circulating Market Cap: $2.839B)

According to Gate market data, ARB is now trading at $0.5555, up about 17.80% in the last 24 hours. Arbitrum is an Ethereum Layer 2 scaling solution that uses Optimistic Rollup technology to significantly improve transaction throughput and execution efficiency, while maintaining Ethereum mainnet’s security and compatibility. It aims to provide developers and users with a low-cost, high-performance on-chain experience.

Recently, the project has been active in AI and infrastructure initiatives, including a collaboration with USD.AI to tokenize GPU assets for yield generation and lending, with incentive funding provided to expand on-chain AI financing capabilities. The team also launched the “Builder’s Block” developer information column and participated in multiple ecosystem and industry events, further strengthening community and developer ties. These combined factors may have boosted market confidence in Arbitrum’s ecosystem potential.

Hotpot Insights

Crypto Total Market Cap Hits All-Time High of $4.21 Trillion; Bitcoin Surpasses Alphabet to Rank 5th Globally

According to CoinGecko, the total cryptocurrency market cap has surpassed $4.21 trillion, an all-time high, with a 24-hour gain of 3.5%. Meanwhile, Bitcoin’s price has reached new highs, pushing its market cap to $2.45 trillion—overtaking Alphabet (Google’s parent company)—and climbing to 5th place in 8marketcap’s global top asset rankings. This milestone reflects the growing weight of digital assets in the global financial landscape and underscores the combined impact of institutional capital inflows and macroeconomic tailwinds.

The current rally is being fueled by Bitcoin’s record highs lifting the overall beta, sustained net inflows into spot-compliant products, and improved on-chain capital efficiency driven by increased activity in Ethereum and Layer 2 networks. Looking ahead, investors should monitor spot ETF flows, futures open interest and funding rates, stablecoin inflows, and on-chain activity to gauge the rally’s sustainability and the health of market structure.

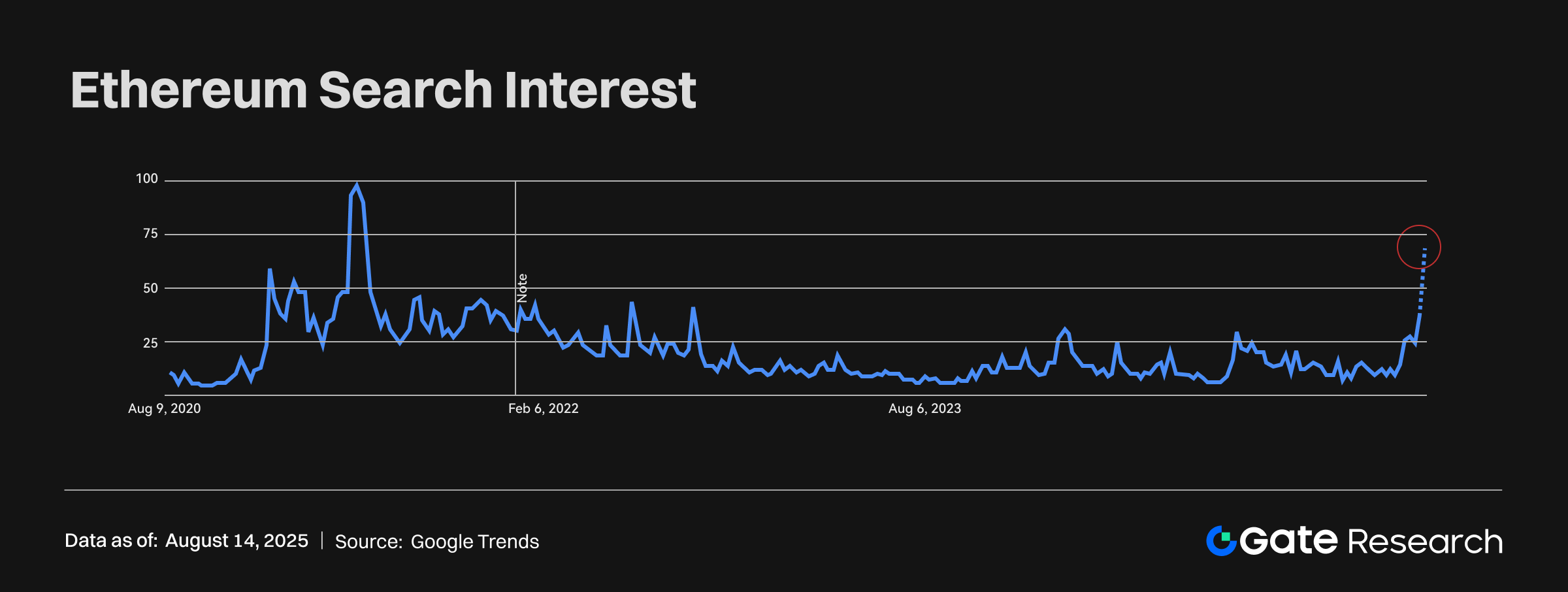

Ethereum Search Interest Hits Highest Since 2021, Price Gains Supported by On-Chain Activity

Google Trends data shows that searches for “Ethereum” have reached their highest level since 2021, while “altcoin” searches are at a five-year high—signaling that market attention has expanded from major assets to a broader range of crypto assets. ETH, after breaking above $4,300 USDT, has been consolidating in the $4,500–$4,670 range, marking a nearly four-year high, while on-chain activity continues to climb, with daily transaction counts recently hitting a record ~1.87 million. Combined with ETF holdings and institutional inflows, these factors provide a strong fundamental and capital base for the price.

Historically, spikes in search interest often indicate a surge in retail participation, and the record “altcoin” interest suggests that capital and sentiment are spreading rapidly into small- and mid-cap assets. In this environment, Ethereum’s demand across payments, DeFi, and its application ecosystem is rising in tandem, creating a two-way push from both price and fundamentals. More broadly, the altcoin sector may also benefit from heightened risk appetite, driving the continuation of structural rallies. Overall, the market currently enjoys both retail enthusiasm and institutional accumulation—two key drivers that could sustain strength in the short term and build momentum for medium-term gains.

Base Daily DEX Volume Surpasses $2 Billion, On-Chain Activity Reaches Multi-Month High

According to Dune data, decentralized exchange (DEX) trading volume on Base has surpassed $2 billion in a single day for the first time, marking a multi-month high and highlighting its trading activity and capital capacity in the Layer 2 space. This volume surge reflects both a recovery in market sentiment and Base’s competitive advantages in low fees and execution efficiency.

Breaking down the numbers, Aerodrome is the dominant DEX on Base, recording about $879 million in 24-hour volume (over 40% market share), followed by Uniswap at roughly $626 million. Together, they account for more than 70% of Base’s daily trading volume, indicating high capital concentration in top protocols.

The rapid growth in trading volume may be linked to increased activity in trending tokens, continued rollout of ecosystem projects, and cross-chain capital inflows. With the advantage of low-cost transactions, Base is steadily attracting more high-frequency traders and liquidity providers, enhancing both depth and activity. If this trend continues, Base could further solidify its position in the Ethereum Layer 2 ecosystem and exert lasting influence on the broader DEX landscape.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/trade/GT_USDT

- Gate, https://www.gate.com/price

- X, https://x.com/MarcShawnBrown/status/1955507198814990404/photo/1

- X, https://x.com/jessepollak/status/1955268199294849382

- CoinGecko, https://www.coingecko.com/en/global-charts

- 8marketcap, https://8marketcap.com/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review