Gate Research: AI Sector Tokens Surge|Linea Set to Launch TGE and ETH Yield Feature

Crypto Market Overview

BTC (+0.22% | Current Price: 111,547 USDT)

Recently, BTC has entered a continuous correction after facing resistance near the 124,497 USD high, forming a clear downward channel. The current price is around 111,500 USD, maintaining low-level consolidation for several days. In terms of moving averages, short-term MAs (MA5, MA10) have repeatedly crossed below MA30, indicating that bears remain in control. Notably, BTC formed a local low near 108,688 USD and rebounded with increased volume, suggesting some support in this area.

If BTC can hold the 111,000–112,000 USD range, a short-term recovery toward the 114,000 USD resistance may be possible. Conversely, a break below the 110,000 USD round number could test the previous low around 108,500 USD. Overall, BTC remains in a weak consolidation pattern, and investors should focus on volume changes and whether support levels hold to gauge the balance of bullish and bearish forces.

Additionally, on August 27, BTC ETFs recorded a net inflow of 81.4 million USD, including 50.9 million USD into BlackRock’s IBIT and 14.7 million USD into Fidelity’s FBTC.

ETH (-1.21% | Current Price: 4,517 USDT)

ETH has entered a correction after encountering resistance near 4,956 USD and is currently trading around 4,518 USD. The overall trend shows high-level downward consolidation, but clear support has emerged around 4,063 USD, accompanied by a volume-backed rebound, indicating active defense by bulls. Short-term moving averages (MA5, MA10) have frequently intertwined with MA30, reflecting the market is in a consolidation phase. It is notable that ETH has repeatedly surpassed the 4,500 USD key level during rebounds, suggesting this price is gradually forming a new support.

Looking ahead, if ETH can maintain the 4,480–4,500 USD range, it may attempt to break toward 4,650–4,700 USD, with a further test of the previous high around 4,950 USD if successful. Conversely, a break below 4,450 USD could trigger a pullback toward 4,300 USD or even 4,100 USD. Overall, ETH is in a mildly bullish consolidation range, with bulls and bears still competing. Investors should watch trading volumes and the stability of the 4,500 USD support.

On August 27, ETH ETFs recorded a net inflow of 307 million USD, including 262 million USD into BlackRock’s ETHA and 20.5 million USD into Fidelity’s FETH.

GT (-0.58% | Current Price: 16.95 USDT)

GT has fallen back after hitting a high of 21.93 USD and is currently trading around 16.95 USD. Since the peak, the price has experienced a noticeable decline and found support near 16.30 USD, entering a low-level consolidation phase.

Short-term moving averages (MA5, MA10, MA30) are exerting downward pressure below 17 USD. Attempts to break above the MAs have lacked momentum, indicating weak bullish energy and a continued weak recovery pattern. Volume analysis shows increased trading during the decline, but volume gradually reduced during the 16.5–17 USD consolidation, suggesting selling pressure has eased while buying strength has not yet fully emerged.

Looking ahead, if GT can hold the 16.3 USD support and break above the 17.5 USD resistance with volume, a rebound toward 18.5–19 USD could be expected. Conversely, a break below 16.3 USD may accelerate the decline, testing 15.5 USD or lower. Overall, GT is in a low-level consolidation phase, with short-term cautious sentiment. Key factors to watch are the 16.3 USD support and whether trading volume can effectively increase.

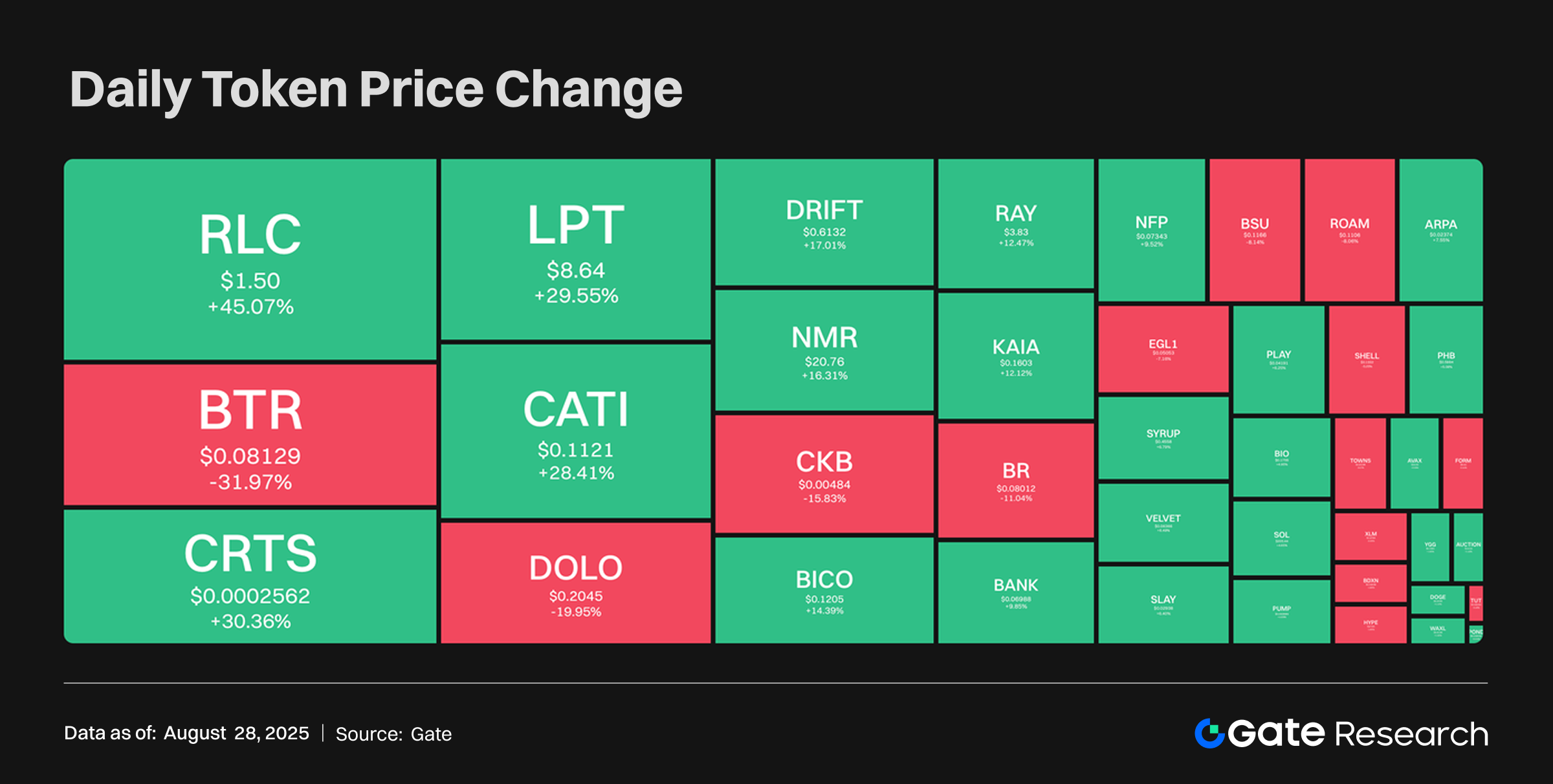

Tokens Heatmap

Market sentiment remains generally positive, with a few tokens such as RLC, LPT, and GOAT posting gains of over 30%, leading the market and reflecting concentrated capital inflows and strong upward momentum. In contrast, BTR (Biteye) dropped by -31.97%, becoming the worst-performing token, possibly due to project developments, market selling pressure, or potential negative news. Meanwhile, DOLO and CKB also recorded declines of over 15%, highlighting the high volatility and potential risks amid rapid rotation of market hotspots.

RLC iExec (+45.07%, Market Cap: 109M USD)

According to Gate data, RLC is currently priced at 1.5 USD, up approximately 45.07% in 24 hours. iExec is a blockchain-based decentralized computing marketplace that connects compute resource providers with users, enabling anyone to rent computing power, datasets, and applications to provide scalable and secure computation for DApps. RLC is used to pay for servers, data, and application usage.

Recently, iExec announced successful deployment of September tasks on Twitter. Coupled with the overall strength of the AI + DePIN sector, RLC, as a veteran AI project, surged sharply. The price rose from around 0.95 USD to a high of 1.8466 USD, nearly doubling in a short period. Trading volume expanded significantly, indicating strong capital inflows supporting the upward movement.

LPT Livepeer (+29.55%, Market Cap: 383M USD)

According to Gate data, LPT is currently priced at 8.64 USD, up approximately 29.55% in 24 hours. Livepeer is an open-source, Ethereum-based video streaming platform, and LPT is its protocol token. Token holders can stake LPT to perform work on the network and earn new tokens and rewards daily.

The AI sector sentiment has been bullish recently, driven by multiple positive factors. NMR surged due to a 500M USD investment commitment from JPMorgan, attracting capital into the AI-related segment and driving linked gains for other AI tokens. As a Grayscale-held AI concept token, LPT benefited from this capital inflow. Technically, LPT reached a short-term high of 9.6 USD with strong volume, reflecting continued market attention and enthusiasm for the sector.

GOAT Goatcoin (+90.61%, Market Cap: 15.13M USD)

According to Gate data, GOAT is currently priced at 0.015 USD, up approximately 90.61% in 24 hours. GOAT is a Meme token within the Solana ecosystem, inspired by the “doge + goat = a better world” concept proposed by Dogecoin co-founder Jackson in 2014.

On August 27, James Wynn publicly recommended Goatcoin (GOAT) on X, predicting its market cap could reach several billion USD. Following this, GOAT surged over 200% in a short time, with total trading volume exceeding 10M USD within just 6 hours of listing, demonstrating the high speculation and capital chasing in the Meme coin sector.

Hotpot Insights

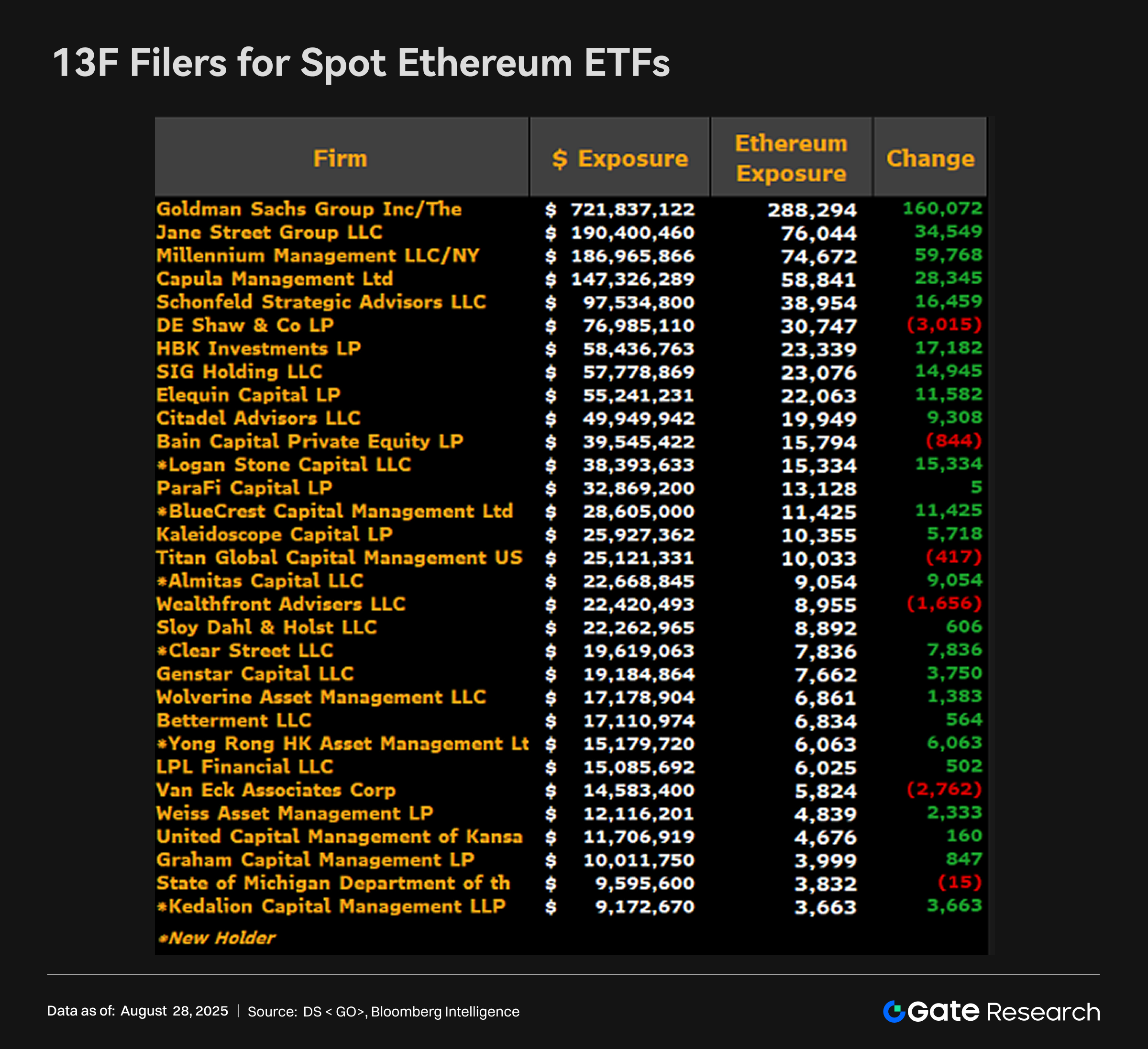

Institutional Investors Pour into Ethereum ETFs, Goldman Sachs Leads Wall Street with $720M Exposure

According to the latest 13F filings, Goldman Sachs currently holds $721 million in Ethereum spot ETF exposure, ranking first among global institutions and highlighting its strong focus and clear positioning in ETH assets. Following closely are market maker Jane Street with $190 million and multi-strategy hedge fund Millennium with $186 million. These figures indicate that Wall Street’s top-tier institutions have moved beyond exploratory strategies and are now actively allocating assets to Ethereum.

This reporting season also saw large banks, hedge funds, asset managers, quantitative trading firms, and pension funds emerging as Ethereum ETF participants. Unlike Bitcoin ETFs, Ethereum ETFs emphasize technology and ecosystem value, attracting institutions with long-term growth perspectives. If regulatory conditions remain accommodative and Ethereum achieves a deflationary structure or improved on-chain yield mechanisms, ETH could increasingly be recognized as a “super cash-flow tech asset” and take on a more prominent role in institutional portfolios.

Linea to Conduct TGE in September, Launch Native ETH Yield in October

Linea announced that it will initiate its Token Generation Event (TGE) in September 2025, with an initial valuation of approximately $2 billion, accompanied by a series of liquidity incentive programs aimed at boosting ecosystem TVL above $1.8 billion. Simultaneously, Linea will launch a 10-week “Linea Ignition” incentive plan and roll out native ETH yield functionality in October.

Currently, Linea is the top-ranked zkRollup by TVL, completing 283 million transactions and supporting 7 million wallet addresses. Its architecture is closely integrated with Ethereum, featuring ETH staking vaults, low-cost transactions, and a 20% fee burn mechanism. Token distribution allocates 85% for community and developer incentives, emphasizing a decentralized ecosystem orientation.

The TGE not only sets a $2 billion initial valuation but, combined with liquidity and yield incentives, anchors rapid capital expansion for the ecosystem. Its TVL target and native ETH yield feature aim to strengthen user capital stickiness, enhancing Linea’s competitive edge in the zkRollup sector. Given the intense L2 competition on Ethereum, Linea’s large-scale token and incentive release could drive short-term developer engagement and capital migration, adding a new variable to the L2 market landscape.

Aave Labs Launches Horizon, Enabling Institutions to Borrow Stablecoins Against Tokenized Assets

Aave Labs has launched Horizon, a platform designed to provide institutional investors with the ability to borrow stablecoins using tokenized real-world assets (RWAs) as collateral. Initially, qualified institutions can leverage tokenized assets such as U.S. Treasury bonds or crypto-backed funds to borrow USDC, RLUSD, and GHO. The first supported assets include Superstate short-term U.S. Treasury funds, Circle Yield Fund, and Centrifuge’s tokenized Janus Henderson products.

Horizon marks Aave’s accelerated entry into the institutional RWA lending market. By integrating traditional financial assets like treasuries into DeFi collateral frameworks, Aave broadens stablecoin issuance and usage scenarios while providing institutions with short-term liquidity and yield management tools. This not only increases demand for stablecoins and liquidity for RWAs but also promotes deeper DeFi-TradFi integration. With expanded collateral coverage under a compliant framework, Horizon could become a key bridge for institutional DeFi adoption and a new growth curve for Aave.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/trade/GT_USDT

- Gate, https://www.gate.com/price

- X, https://x.com/Cointelegraph/status/1960885288583999981

- X, https://x.com/sk_sahil24/status/1960674218053664941

- Coindesk, https://www.coindesk.com/business/2025/08/25/aave-labs-debuts-horizon-to-let-institutions-borrow-stablecoins-against-tokenized-assets

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review