Gate Research: BTC and ETH Rebound Slightly|Gate Launches Ondo Section to Trade Tokenized Stocks Onchain

Crypto Market Overview

BTC (+0.68% | Current Price: 111,565 USDT)

BTC remains in a short-term consolidation pattern, with prices fluctuating above key hourly moving averages, indicating relative short-term stability. The MACD shows a bearish crossover, with declining histogram bars and weakening momentum. If BTC fails to reclaim the 112,000 level soon, it may retest support at 111,000 or even 110,000. Conversely, a breakout above 112,500 with strong volume could open the door for further upside.

ETH (+2.11% | Current Price: 4,438 USDT)

ETH has rebounded after a sharp dip and is now in a consolidation phase. It faces short-term resistance around the 4,470 level. The MACD indicates an early-stage bearish crossover, with weakening short-term momentum. If ETH fails to break above 4,500, it may pull back to test the 4,400–4,350 support zone.

GT (+0.32% | Current Price: 17.004 USDT)

GT continues its steady upward movement, trading above key short-term moving averages. The 5-day and 10-day MAs show a bullish alignment, with price action gradually trending higher. The MACD remains in a bullish crossover, with moderate bullish momentum. If volume sustains, GT may challenge the recent high at 17.15. Key support lies at 16.90, with potential downside to 16.70 if breached.

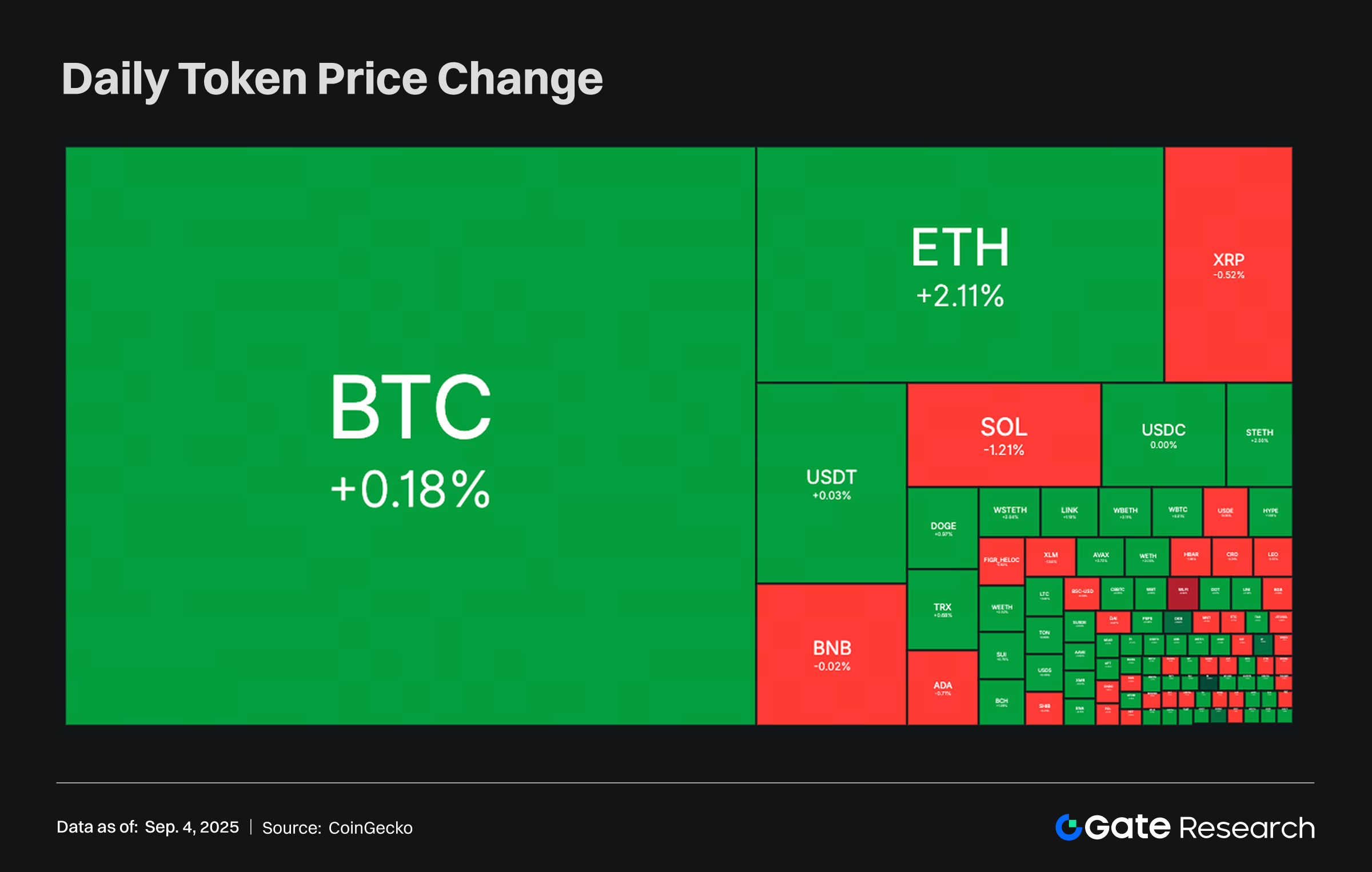

Tokens Heatmap

In the past 24 hours, the crypto market maintained a slightly bullish consolidation trend, with most major tokens posting gains. BTC edged up 0.18%, continuing to trade within a high-level consolidation range. ETH performed relatively stronger, rising 2.11% and boosting overall market sentiment, while some large-cap tokens such as SOL and XRP saw minor pullbacks. Overall, while no clear breakout was observed, the price baseline of leading assets moved slightly upward, and sectoral divergence persisted.

At the same time, several small-to-mid cap tokens with strong narratives gained notable attention, including Story Network (IP, +5.14%), Maple (SYRUP, +7.64%), and Ethena (ENA, +5.07%). Their performance reflects growing investor interest in projects with ecosystem momentum or narrative clarity.

IP Story Network (+5.14%, Circulating Market Cap: $2.073B)

According to Gate, IP is currently priced at $8.281, up 5.14% in the past 24 hours. Story Network focuses on decentralized intellectual property (IP) management and creator incentives. Two recent developments have sparked renewed market attention:

First, its ecosystem application Aria Protocol announced a $15 million funding round with backers including Polychain and Story Foundation. The project aims to tokenize revenue rights from streaming content and has already supported songs from artists like BLACKPINK, BTS, and Dua Lipa.

Second, its application Poseidon was recently launched on the Worldcoin Mini App Store, allowing users to earn points by uploading voice data—contributing to the training of AI models.

This rally appears to be driven by growing confidence in Story’s real-world adoption in the intersection of AI and music IP, coupled with broader bullish sentiment in the IP token sector.

ENA Ethena (+5.07%, Circulating Market Cap: $4.812B)

According to Gate, ENA is currently trading at $0.7201, up 5.07% over the last 24 hours. Ethena is a protocol focused on on-chain dollar-denominated assets and yield-bearing structures. Its core product, USDe, is a “synthetic stablecoin” not reliant on traditional banking infrastructure, instead utilizing on-chain collateralization and hedging strategies for price stability.

ENA serves as the governance and reward token of the platform, participating in revenue distribution and protocol governance.

This week’s rally followed a series of positive metrics: USDe’s centralized exchange circulation surpassed $1 billion, and its overall market cap has reached $12 billion—making it the fastest-growing digital dollar asset in history. Ethena’s cumulative interest income has also exceeded $500 million, suggesting a maturing revenue model. These figures boosted investor confidence in Ethena’s position within the on-chain dollar space.

SYRUP Maple (+7.64%, Circulating Market Cap: $559M)

According to Gate, SYRUP is priced at $0.49751, up 7.64% in the last 24 hours. Maple is an on-chain credit market protocol serving institutional lending needs. Recently, it launched syrupUSDC on the Arbitrum network—a derivative stablecoin that can be used as collateral to borrow major stablecoins like USDC, USDT, and GHO.

syrupUSDC is now integrated with multiple lending protocols including 0xfluid, MorphoLabs, and Euler. Its inclusion in the Arbitrum DRIP incentive program allows users to earn additional rewards when using syrupUSDC as collateral.

This rollout has expanded syrupUSDC’s utility and may have boosted overall platform activity, contributing to SYRUP’s short-term price appreciation.

Hotpot Insights

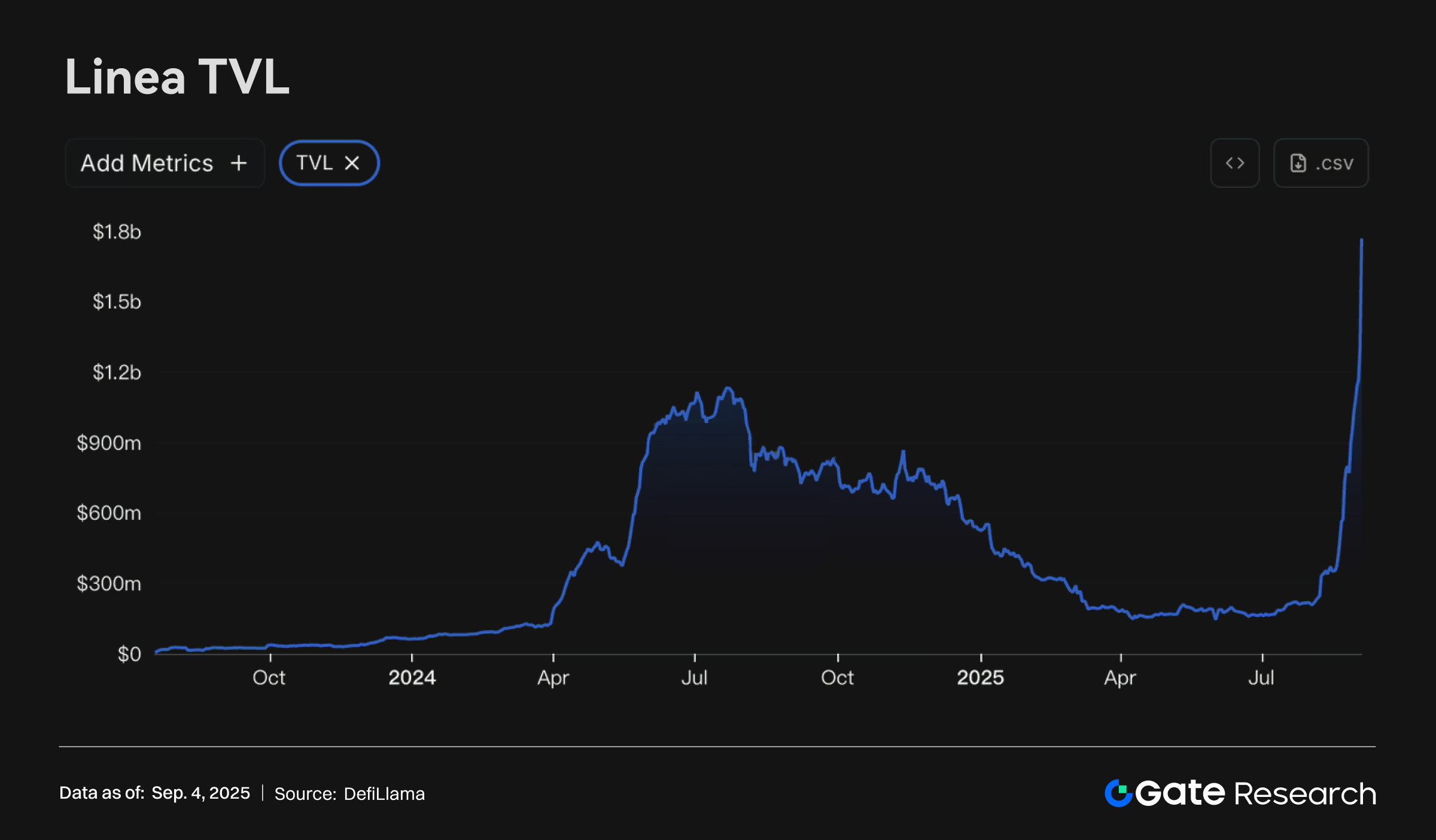

Linea TVL Surpasses $1.8 Billion as Liquidity Incentive Program Goes Live

According to DefiLlama, the total value locked (TVL) on the Linea network has surged to $1.894 billion, marking a 24-hour increase of approximately 17.05% and setting a new all-time high. The recent rise in TVL reflects both accelerated capital inflows and increased ecosystem activity.

One of the key drivers of this growth is the launch of the Ignition incentive program on September 3. Linea announced it will distribute 1 billion LINEA tokens to attract liquidity and user participation. Initial partner protocols include Etherex, Aave, and Euler, with incentives focused on lending and trading use cases. The program is now open to participants, though its long-term impact on user retention remains to be seen.

Gate Launches Ondo Section, Enabling Tokenized Stock Trading

Crypto exchange platform Gate has officially launched its Ondo Section, opening trading for 26 tokenized stock pairs, including AAPLON, METAON, TSLAON, and NVDAON, all available for trading with USDT.

The section is developed in partnership with Ondo and is based on a compliant model for real-world asset tokenization. Each listed token is backed 1:1 by publicly traded stocks, fully collateralized, and transferable on-chain with cross-chain and multi-ecosystem compatibility.

To celebrate the launch, Gate is hosting a CandyDrop campaign from September 4 to September 17, during which users who trade in the Ondo Section can share a total of 384,615 ONDO tokens, with a maximum of 220 tokens per person. The section also supports fractionalized trading, 24/7 market access, and on-chain transfers, offering improved accessibility compared to traditional markets.

Galaxy Digital Partners with Superstate to Tokenize GLXY Stock on Solana

Galaxy Digital has announced a partnership with asset tokenization platform Superstate to bring its GLXY stock onto the Solana blockchain, enabling on-chain issuance of tokenized shares.

According to the announcement, KYC-verified investors can convert their GLXY holdings into tokens via Superstate’s Opening Bell platform, and transfer or trade them on supported DeFi platforms.

Superstate stated that this marks the first instance of a publicly listed company’s shares being directly tokenized and traded on a public blockchain. While participation remains subject to regulatory review and investor eligibility, the initiative highlights a growing convergence between traditional equity markets and blockchain infrastructure—particularly within open financial ecosystems.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/crypto-market-data

- Investing, https://investing.com/indices/usa-indices

- Investing, https://investing.com/currencies/xau-usd

- Coinmarketcap, https://www.coingecko.com/en/cryptocurrency-heatmap

- DefiLlama, https://defillama.com/chain/linea

- X, https://x.com/TheBlock__/status/1963195292095791359

- Gate, https://www.gate.com/announcements/article/46930

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review