Gate Research: Crypto Market Rebounds Amid Volatility | Google Cloud Unveils GCUL L1

Crypto Market Overview

BTC (+0.14% | Current Price: 111,449 USDT)

BTC remains in a consolidation and bottom-building phase. On the 1-hour chart, short-term moving averages have moved back above the MA30, signaling short-term stabilization, though a clear reversal structure has yet to form. The MACD indicator shows a bullish crossover with increasing histogram bars, although momentum appears to be slowing. Trading volume has not expanded significantly, suggesting the rebound is still a mild technical recovery. If BTC can hold above 111,000, it may challenge the previous high around 112,500. Otherwise, a pullback to test support at the psychological level of 110,000 could follow.

ETH (+0.45% | Current Price: 4,582 USDT)

ETH shows stronger short-term performance than BTC, currently trading above its short-term moving averages, which are aligned in a bullish pattern. The MACD bullish crossover continues, with rising red histogram bars and no sign of fading momentum. Volume is also gently increasing, indicating healthy buying support during the rebound. If ETH can sustain above 4,580, it may attempt to test the 4,700–4,800 range. Key short-term support levels include the 4,500 psychological level and the dynamic support from the MA10.

GT (-0.25% | Current Price: 17.036 USDT)

GT continues to trade in a low-range consolidation pattern and remains constrained below the MA30. All three major moving averages show a slight bearish alignment, reflecting cautious sentiment from buyers. While the MACD has formed a low-area bullish crossover, histogram momentum is weak, and price lacks clear directional bias. Overall volume remains low, indicating limited strength in rebound attempts. Near-term price action hinges on whether GT can break and hold above the 17.00–17.20 zone with volume support. If it fails and drops below 16.80, it may retest the recent local low at 16.66.

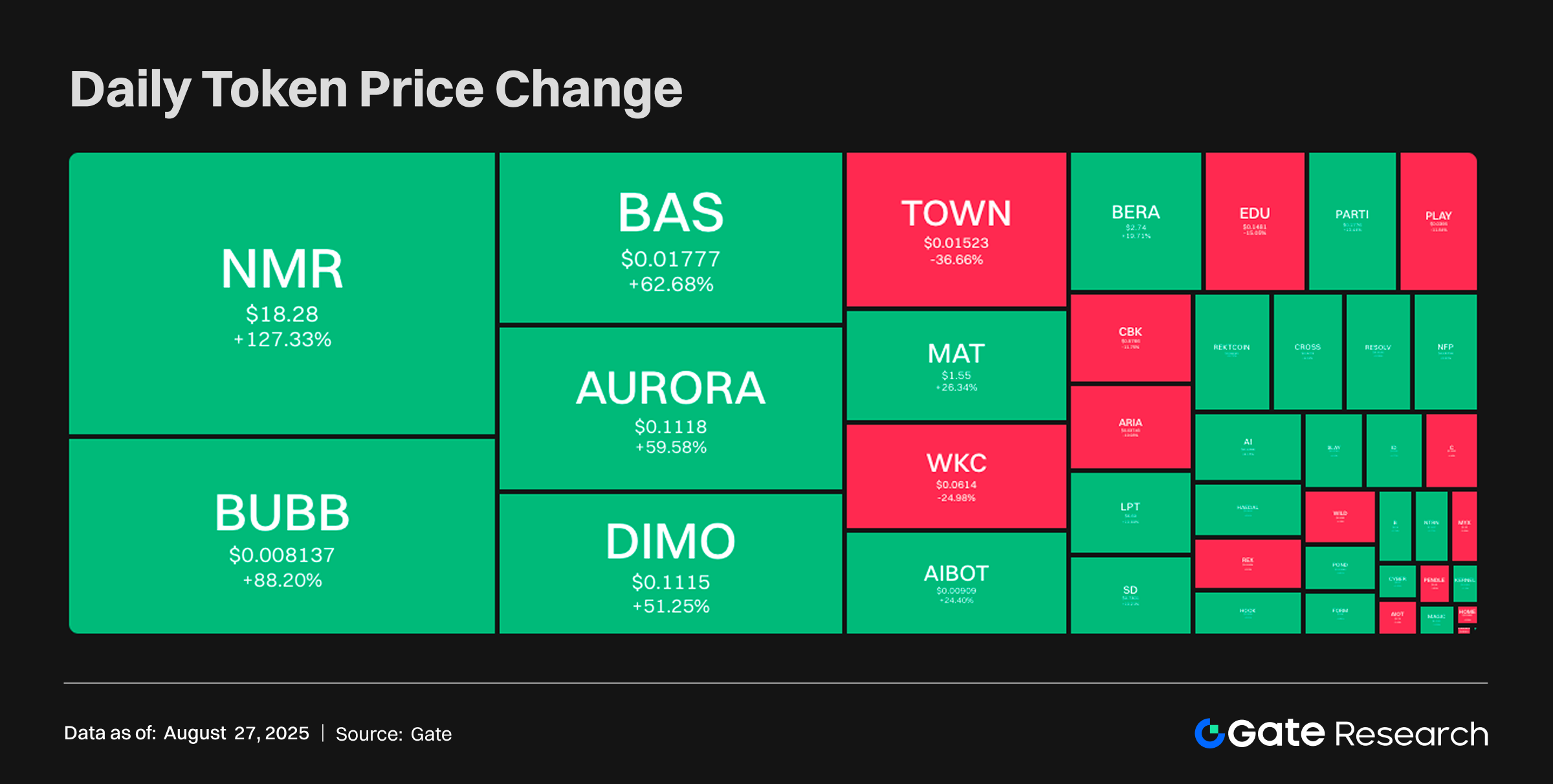

Tokens Heatmap

In the past 24 hours, the crypto market has shown a choppy rebound. Capital has notably flowed into small- and mid-cap tokens, with NMR (+127.33%) and BUBB (+88.20%) emerging as short-term leaders. On the downside, TOWN (–36.66%) and WKC (–24.98%) posted the largest losses, reflecting capital rotation out of some speculative tokens. While major coins have rebounded modestly, market enthusiasm is clearly concentrated in trending, community-driven small caps, with rapid short-term sector rotation continuing.

IP Story Network (+10.82%, Circulating Market Cap: $1.551 Billion)

According to Gate market data, the IP token is currently priced at $6.192, up approximately 10.82% over the past 24 hours. Story Network is a decentralized protocol focused on intellectual property (IP) and data assets. It aims to provide verifiable and tradable digital creation infrastructure for creators, covering IP registration, tracking, collaboration, and revenue sharing. Its native token, STORY, is used for governance, protocol fee payments, and ecosystem incentives, and powers various creator reward mechanisms on the platform.

The recent surge in IP’s price was driven by positive catalysts, including the announcement of the upcoming “Origin Summit” in 2025, which will focus on the intersection of IP, AI, and crypto. Strategic partners include major players such as HYBE, The Black Label, Grayscale, and Animoca, reinforcing the project’s position in the creator economy and Web3 narrative. In addition, Story Network teased a collaborative AI data contribution initiative with @psdnai, allowing users to earn Poseidon Points through audio uploads and event participation—introducing new use cases and value propositions for the token.

AURORA Aurora (+69.12%, Circulating Market Cap: $76.35 Million)

According to Gate market data, the AURORA token is currently trading at $0.11820, marking a 69.12% increase over the past 24 hours. Aurora is an EVM-compatible network built on the NEAR Protocol that offers high-performance, low-cost Ethereum scaling solutions. Its ecosystem includes Aurora Engine, Aurora Cloud, and multichain deployment tools, with broad support for stablecoins, GameFi, DePIN, and other applications.

The recent rally was largely fueled by ecosystem expansion and infrastructure initiatives, including the announcement that Human Protocol has joined the Aurora ecosystem. This integration brings decentralized labor coordination and fair compensation to on-chain workers, enhancing Aurora’s utility and scalability. The Aurora team also proposed the creation of a stablecoin chain, leveraging Aurora’s virtual chain to build a dedicated fee system aimed at reducing deployment costs and improving predictability—laying the groundwork for broader financial applications and sparking market optimism.

NMR Numeraire (+134.25%, Circulating Market Cap: $148 Million)

According to Gate market data, the NMR token is now priced at $18.829, up 134.25% in the past 24 hours. Numerai is a quantitative hedge fund platform that integrates AI and decentralized models, allowing data scientists worldwide to contribute stock market prediction models. NMR is used for incentivizing model submissions, staking for validation, and rewarding accuracy in data predictions.

The surge in NMR was driven by a major announcement from JPMorgan, which revealed it had allocated $500 million in strategy capacity to the Numerai fund. This milestone marks a major institutional endorsement of AI-driven quantitative strategies. Additionally, growing community interest in NMR’s positioning as an “AI-era hedge fund” and its potential for future market integration has fueled strong investor demand.

Hotpot Insights

Google Cloud Launches GCUL, A Financial-Grade Layer 1 Blockchain for Institutional Infrastructure

Google Cloud has unveiled its in-house Layer 1 blockchain project, Google Cloud Universal Ledger (GCUL), which is currently in a private testnet phase. GCUL is purpose-built for financial institutions, emphasizing neutrality, scalability, and 24/7 support for financial markets. Uniquely, it introduces a Python-based smart contract execution environment, distinguishing it from other Layer 1 blockchains that typically rely on Solidity.

GCUL’s core features include: native support for commercial bank-issued on-chain currencies, 24/7 capital market infrastructure, and agentic capabilities that support programmable payments and delegation. Leveraging Google’s massive ecosystem—ranging from cloud computing and advertising to Android—GCUL enjoys a natural advantage with billions of users and hundreds of institutional partners. Its positioning as “financial infrastructure as a service” could establish it as a new standard for institutions exploring tokenized assets and on-chain settlement systems.

GCUL is already collaborating with the Chicago Mercantile Exchange (CME Group) to pilot tokenized commodity settlement and on-chain payment infrastructure. Google plans to release more technical details in the coming months.

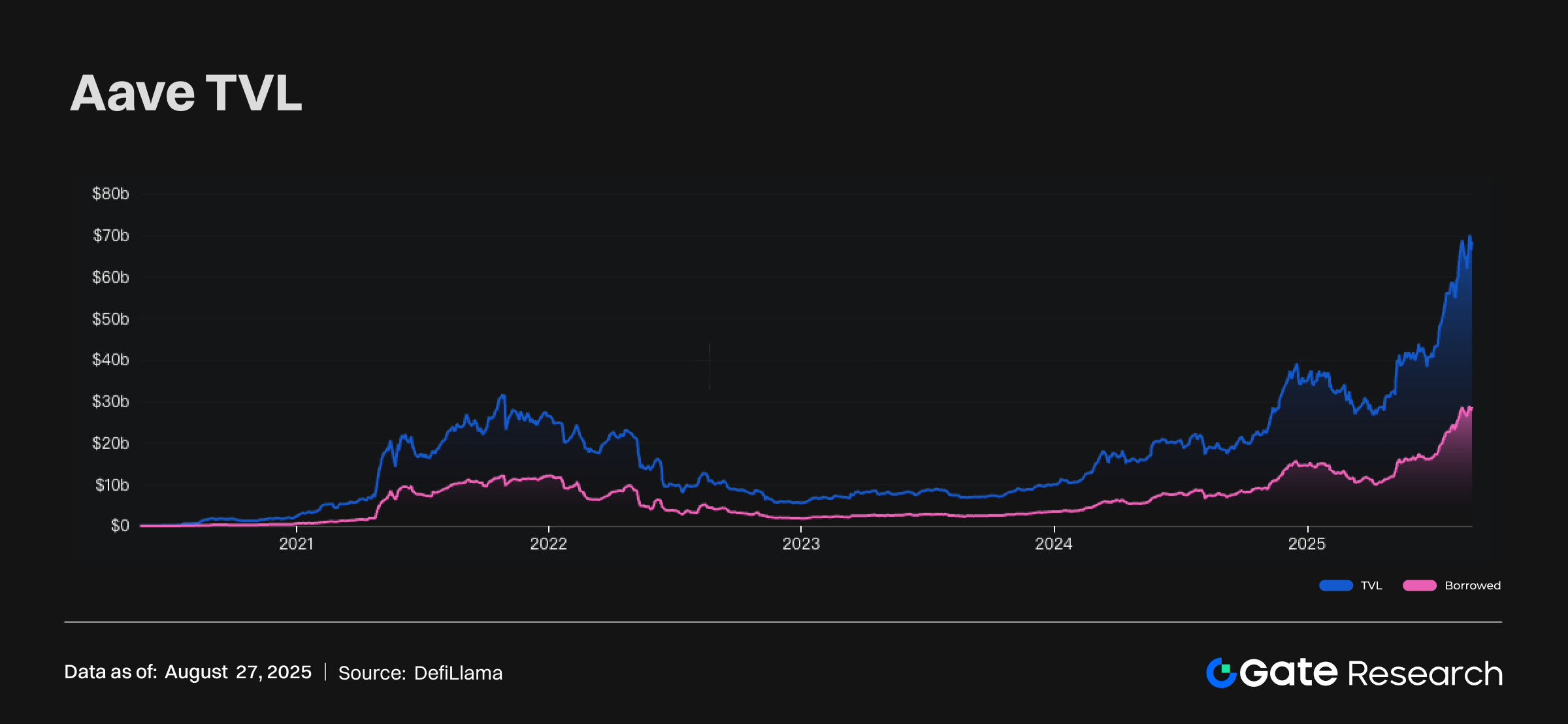

Aave Hits Record High in TVL, Nears Scale of Top U.S. Commercial Banks

According to data from DefiLlama, the total value locked (TVL) on decentralized lending protocol Aave has surpassed $41.1 billion, marking an all-time high. Compared to traditional finance, this places Aave among the top 54 U.S. commercial banks—exceeding Prosperity Bank’s $38.4 billion in deposits and just $300 million shy of Bank OZK.

Including Aave’s outstanding loans of $28.9 billion, the platform’s total capital managed exceeds $70 billion, ranking it among the top 37 U.S. banks—within the top 1.7% of the commercial banking sector. Aave founder Stani Kulechov emphasized that Aave serves as an open financial network that enables institutions to earn yield independent of the Federal Reserve, underscoring DeFi’s structural potential to replace elements of traditional finance.

Aave remains the market leader in DeFi lending, commanding approximately 50% of total market TVL—nearly six times the scale of its nearest competitor, Morpho. This dominance reflects the high level of trust and capital concentration from both retail users and institutions seeking stability and security in decentralized finance.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/crypto-market-data

- Investing, https://investing.com/indices/usa-indices

- Investing, https://investing.com/currencies/xau-usd

- decrypt, https://decrypt.co/336915/commerce-dept-economic-data-gdp-blockchain-howard-lutnick

- X, https://x.com/TheOneandOmsy/status/1960483742083903592

- Cryptoslate, https://cryptoslate.com/aave-reaches-41-1-billion-tvl-record-equivalent-to-being-the-54th-largest-us-bank/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review