Gate Research Daily Report: BTC & ETH ETF Net Inflows Exceed $800M | IXORA Soars 93.24% to Lead the Market

Crypto Market Overview

BTC ( +0.04% | Current Price: 111,277 USDT )

After a round of dipping, the price of BTC quickly stabilized and rebounded, currently standing near $111,000. The short-term bullish momentum has strengthened. The short-term moving averages (MA5, MA10) have shown signs of turning and trying to move closer to MA30, indicating that a short-term recovery is underway. From the perspective of trading volume, there is a certain increase in volume during the rebound, indicating that the buying side is gradually warming up. If the price can effectively break through and stabilize above $112,000, it is expected to further challenge the previous high of $112,500. However, if the attack is weak and falls back below $110,000, it may test the support of the previous low again. Overall, the short-term trend of BTC is biased towards oscillation and strength, and it is necessary to pay attention to the gains and losses of key points.

In addition, on September 4th, Bitcoin spot ETF once again saw a net outflow of funds in a single day, with an overall outflow scale of 222.90 million US dollars. Among them, BlackRock IBIT achieved a net inflow of 134.80 million US dollars, becoming the only product that attracted a large amount of money; Fidelity FBTC outflowed 117.40 million US dollars. Overall, although IBIT still showed the ability to bear funds, other major products generally suffered from capital withdrawal, indicating that institutions are becoming cautious at the current price.

ETH ( -1.63% | Current Price: 4,326 USDT )

After oscillating and consolidating around $4300, ETH recently fell to a low of $4211, but quickly rebounded. Currently, the price has returned to above $4320, showing signs of stabilization in the short term. In terms of moving averages, MA5 and MA10 have gradually approached and attempted to form a golden cross. If they can break through the suppression of MA30 in the future, it will further strengthen the rebound signal. From the observation of trading volume, the low-level rebound is accompanied by a certain amount of buying volume, indicating that the market has a willingness to accept the current price level. If ETH can break through the $4400 mark, it is expected to start a new round of upward movement; conversely, if it falls below $4250, it may continue the oscillating and consolidating pattern. Overall, ETH is in a recovery trend and needs to pay attention to the resistance and support above.

On September 4, Ethereum spot ETFs recorded a total net outflow of USD 167.3 million. During this period, BlackRock’s ETHA saw an inflow of USD 148.8 million, serving as the main source of incremental market funds, while Fidelity’s FETH experienced an outflow of USD 216.7 million. Overall, the market remained under pressure from large withdrawals, reflecting a divergence in institutional sentiment toward Ethereum allocations.

GT ( -0.66% | Current Price: 16.82 USDT )

GT has maintained a narrow range of fluctuations recently, with prices repeatedly consolidating around $16.8, lacking a clear direction in the short term. The three moving averages (MA5, MA10, MA30) are intertwined, indicating that the current market is in a state of long-short tug-of-war and has not yet formed a clear trend. In terms of trading volume, the overall level is moderate, with only local volume appearing, indicating a heavy wait-and-see sentiment among funds. If GT can break through the stage high of $17.15 and the trading volume effectively increases, it may open up further upward space; but if it continues to oscillate below $16.8, it may test the support of $16.5 again. Overall, GT’s trend is biased towards consolidation, and in the short term, it is necessary to wait for direction selection and patiently wait for the breakthrough signal for more stability.

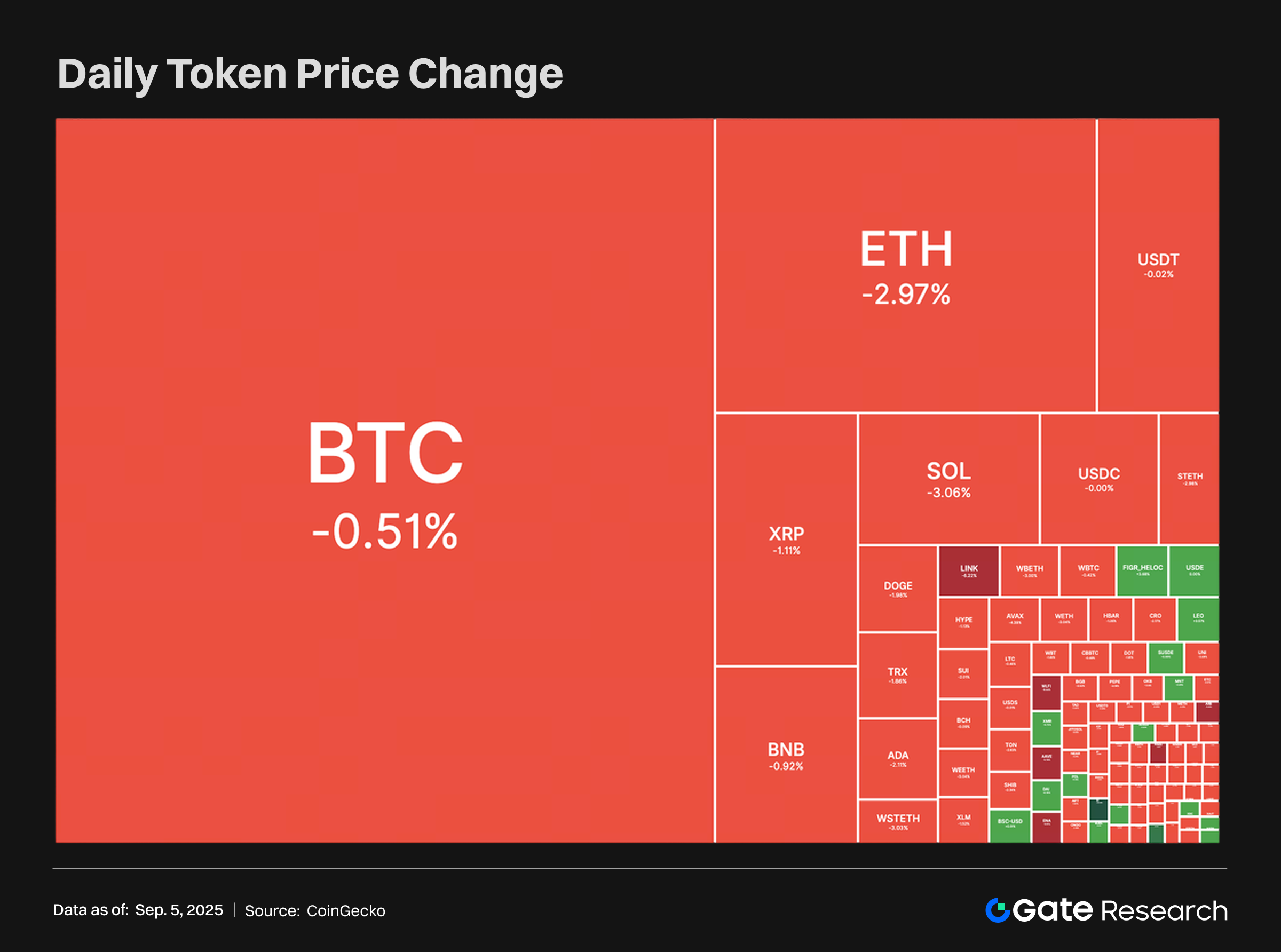

Tokens Heatmap

Most tokens showed a slight pullback, market sentiment tended to calm down, and the active level of funds slightly decreased. IXORA led the market with a gain of up to 93.24% and became the focus. In addition, BTC, ETH, SOL, and XRP fell between 0.5% and 3%, indicating a slowdown in market heat and fund pursuit.

IXORA – IXORAPAD (+93.24%, Circulating Market Cap: $24M)

According to Gate market data, the current price of the IXORA token is $0.000644, an increase of about 93.24% in 24 hours. Ixorapad (IXORA) is a decentralized startup platform that provides early investment opportunities for individual investors and venture capital companies in Gamefi projects. Ixorapad will act as a bridge between investors and the founders of Gamefi projects in the seed and private rounds, with the ultimate goal of expanding the scale of the Gamefi and decentralized financing markets. Ixorapad is committed to helping Gamefi companies accelerate their development by maximizing funds, products, talent, and networks.

The recent update and deployment of IxoraPad has become the core driver for the surge in the price of the IXORA token. The project has built an extensible L2 infrastructure based on the Arbitrum Mainnet and launched a smart contract module to support the tokenization and attribution of game assets. Meanwhile, real-time portfolio rendering has been implemented through IPFS/Arweave, significantly enhancing the product’s application scenarios and visualization performance. Notably, this upgrade has also been optimized for Web3 game developers, focusing on “gaming on the chain”, further strengthening its ecosystem positioning. According to Gate market data, the IXORA token is currently priced at $0.0006044, with a 24-hour increase of 93.24%. As market sentiment improves, funds are flowing in, creating a strong bullish atmosphere in the short term.

LVVA – Levva Protocol (+43.10%, Circulating Market Cap: $175M)

According to Gate market data, the current price of LVVA token is $0.00735, up about 43.10% in 24 hours. Levva Protocol (formerly known as Open Custody Protocol) is an artificial intelligence-driven DeFi portfolio management tool that can handle all the heavy work for users. Its artificial intelligence assistant customizes investment strategies based on user goals, securely and automatically executes profit optimization, and allows users to easily control their investment portfolios. Whether you are a DeFi novice or an experienced user, Levva can make it easy, safe, and optimized to complete all operations, allowing users’ assets to serve them and focus on important things

The core narrative of Levva 2.0 is that AI replaces users in running DeFi, achieving automated asset allocation, rebalancing, and exit through Smart Vaults, without the need for manual operation or reliance on cumbersome reports and panels. This extremely simplified product positioning fits the current market demand for automated revenue tools, significantly increasing attention. As the concept ferments, the market resonates strongly with the narrative that it can continuously generate revenue by depositing once. According to Gate market data, the current price of LVVA token is $0.00735, with a surge of 43.10% in 24 hours, and the trading volume has increased synchronously, reflecting the rapid influx of funds and a bullish market sentiment.

PTB – Portal To Bitcoin (+35.39%, Circulating Market Cap: $981M)

According to Gate market data, the current price of the PTB token is $0.04536, an increase of 35.39% in the past 24 hours. Portal to Bitcoin is a platform that connects Bitcoin with DeFi and cross-chain applications, aiming to truly bring Bitcoin into the core of decentralized finance while maintaining its original security and trustless features.

Portal has officially launched and opened simultaneously on mainstream exchanges. The narrative focus is on its strategic positioning of “introducing globally important Financial Marekt into Bitcoin”. The project team announced that it has received support from the $50 million ecosystem fund provided by Paloma Investments, and has attracted early-stage funds totaling $92 million, laying a solid foundation for ecosystem expansion. With the support of BitScaler technology, Portal emphasizes cross-market connections with zero custody risks, strengthening the value consensus of its Bitcoin native finance. According to Gate market data, the PTB token is currently trading at $0.04536, up 35.39% in 24 hours. With the continuous inflow of funds, the market sentiment is positive, and the bullish atmosphere is gradually heating up.

Daily Token Launch

New Token Sale Details

- Subscription Project: Gata

- Token Name: GATA

- Subscription Period: Until 3:00 (UTC) on September 15, 2025

- Participation Method: Stake GT, GATA or USDT to claim for free

- Total Airdrop Supply: 2,000,000 GATA

Project Introduction

Gata is building advanced decentralized AI inference and training technologies that enable large-scale AI models to efficiently collaborate among globally distributed GPUs, and is committed to generating, distributing, and utilizing high-quality training data in a more fair and efficient manner.

Hotpot Insights

iSpecimen advances $200 million digital asset reserve plan, focusing on Solana ecosystem layout

Biological sample procurement company iSpecimen recently announced that it is actively promoting the establishment of a digital asset reserve treasury with a total scale of $200 million. Currently, multiple cryptocurrency companies are recommending investment opportunities to the company, and iSpecimen has also launched a reserve plan based on Solana. According to the plan, the company will purchase SOLs through over-the-counter with cryptocurrency institutions, including locked SOLs with contract transfer or ownership restrictions, to achieve long-term reserves and risk diversification.

This move not only demonstrates the increasing attention of traditional enterprises to digital assets, but also highlights the attractiveness of Solana in efficient on-chain applications and liquidity ecosystems. iSpecimen’s reserve strategy is expected to further deepen the combination of Web3 and traditional industries, bringing more institutional-level funding attention to Solana. However, at the same time, the contract terms and market volatility risks that lock assets still require companies to be cautious in execution, and investors should also rationally view the possible impact.

The Trump family-backed Thumzup upped the ante in the crypto market by investing in BTC and DOGE mining machines

According to the latest disclosure, Thumzup, a social media company supported by the Trump family, announced in a shareholder letter that it has invested $1 million to purchase Bitcoin and has been authorized by the board of directors to further increase its holdings in various cryptoassets such as DOGE, LTC, SOL, XRP, ETH, and USDC. At the same time, the company has also signed a final acquisition agreement to purchase 2,500 DOGE mining machines, and plans to potentially add another 1,000 in the future, comprehensively deepening its strategic layout in the mining field.

This move shows Thumzup’s positive attitude towards the crypto market, not only by directly participating in cryptocurrency holdings, but also by expanding to mining machine investments, forming a dual allocation of assets and computing power. The allocation of Bitcoin and mainstream counterfeit products helps with Risk Diversification, while the acquisition of DOGE mining machines indicates that the company is optimistic about the potential of the community-driven Meme coin ecosystem. As traditional capital gradually builds up the ante crypto industry, balancing market volatility and long-term value will become the key to Thumzup’s strategic success. Investors should also pay attention to the latent risks of large-scale mining machine investments in energy consumption, income fluctuations, and other aspects.

Plume integrates Circle native USDC and CCTP V2 to promote the development of RWA on-chain financial compliance

Real-world asset (RWA) dedicated blockchain Plume announced a partnership with compliance stablecoin publisher Circle to integrate native USDC and cross-chain transfer protocol CCTP V2 into the Plume network. This partnership allows users to directly access and trade USDC on Plume without relying on cross-chain assets, while reducing friction and risk in multi-chain fund flows with the seamless cross-chain function of CCTP V2. Through this mechanism, users can also use USDC to mint native stablecoin pUSD, providing collateral and settlement support for institutional-level RWA transactions.

Since its mainnet launch in June 2025, Plume has attracted over 196,000 asset holders and integrated over 200 applications and protocols, demonstrating strong ecosystem growth. This partnership with Circle further strengthens Plume’s compliance and liquidity, providing a more robust foundation for institutional users to enter the on-chain RWA Financial Marekt. With the accelerated integration of compliance stablecoins and cross-chain technology, Plume’s competitiveness in the RWA track is expected to significantly improve, but at the same time, the market still needs to pay attention to the latent risks brought by regulatory environments and the expansion of on-chain financial instruments.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/trade/GT_USDT

- Gate, https://www.gate.com/price

- Gate, https://www.gate.com/launchpool/BSU?pid=355

- CoinGecko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Foresightnews, https://foresightnews.pro/news/detail/83288

- Foresightnews, https://foresightnews.pro/news/detail/83287

- Foresightnews, https://foresightnews.pro/news/detail/83239

- Gate Launchpool, https://www.gate.com/announcements/article/46956

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review