Gate Research: Ethereum Foundation Launches Phase Two of "Trillion Dollar Security" | MetaMask Introduces mUSD Stablecoin

Crypto Market Overview

BTC ( -0.70% | Current price 112,909 USDT)

BTC price fluctuated by -0.70% over the past 24 hours. BTC is currently in a sideways consolidation state. Trading indicators such as MACD and RSI are relatively neutral, showing no significant trend trading opportunities in the near term.

Additionally, on August 21st, BTC ETFs saw an outflow of $194 million, with BlackRock’s IBIT accounting for $127 million and ARK’s ARKB for $43.3 million.

ETH ( -0.42% | Current price 4,288 USDT)

ETH dropped 0.42% over the past 24 hours. After touching the $4,000 bottom, ETH has shown an oscillating upward trend over the past 2 days. ETH’s short-term resistance is at the $4,400 level.

On August 21st, ETH ETFs saw an inflow of $240 million, with BlackRock’s ETHA accounting for $233 million and Fidelity’s FETH for $28.5 million.

GT ( +1.56% | Current price 17.91 USDT)

In the past 24 hours, the GT token price increased by 3.44%. The K-line chart shows that GT has demonstrated a trend of rising volume and price over multiple hours. GT’s short-term resistance is at the $20 level.

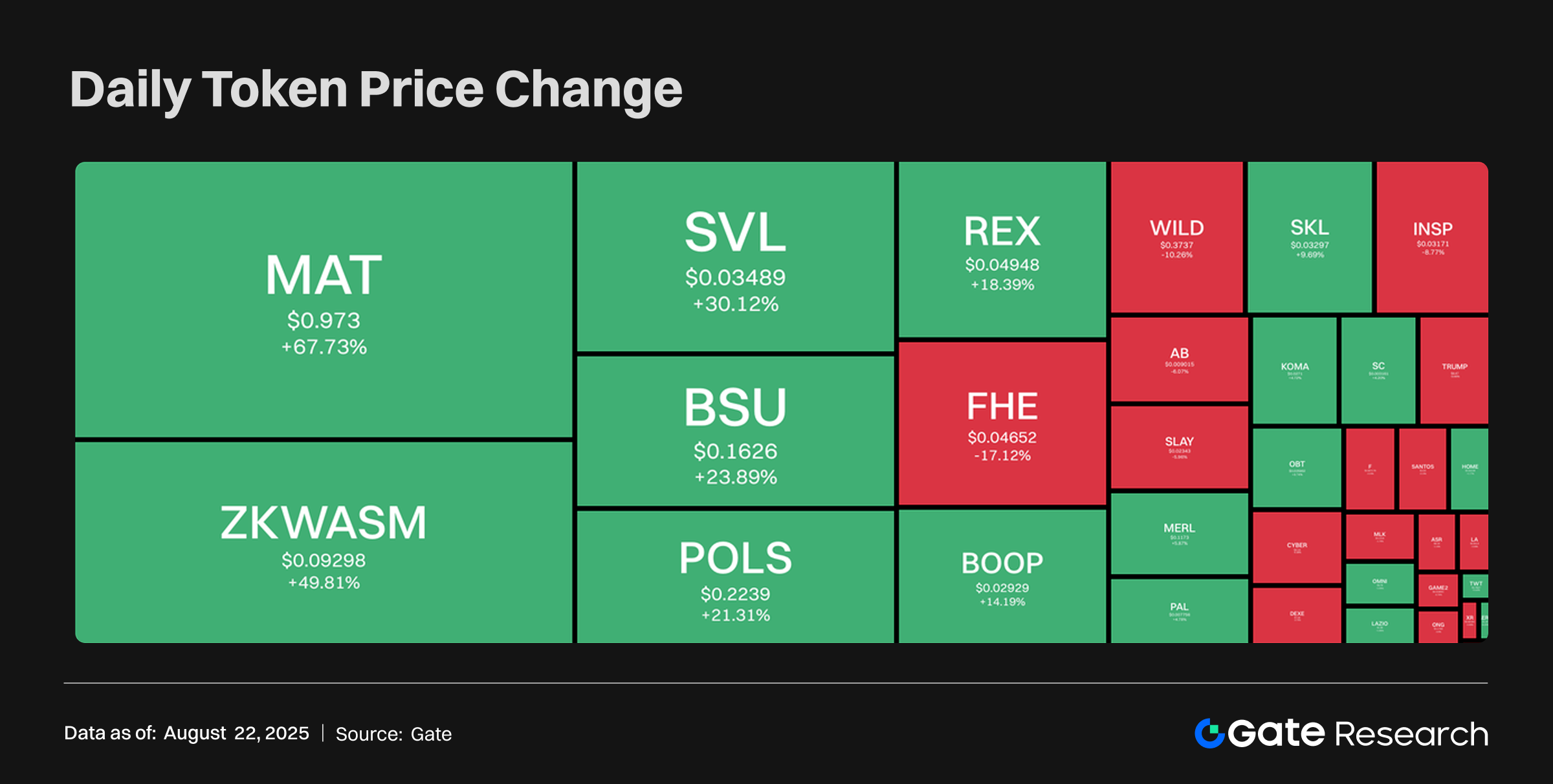

Tokens Heatmap

Yesterday, most tokens continued to decline. However, some small-cap tokens achieved gains, with MAT leading the entire crypto market with a 67.73% increase. Among the top 100 tokens, the median change over the past 24 hours was a decrease of 1.83%.

BIO Bio Protocol (+23.50%, Market Cap $313 million)

According to Gate.io market data, the BIO token is currently priced at $0.188, with a 24-hour increase of 23.50%. Bio Protocol is a decentralized science (DeSci) protocol aimed at providing decentralized support for global scientific research. Its core objective is to break down barriers in traditional scientific funding models by using blockchain technology to facilitate fund flow, resource sharing, and innovative incentive mechanisms in scientific research, thereby promoting faster, more transparent, and efficient research progress. Bio Protocol combines the decentralized nature of blockchain with funding and governance in biomedical and scientific research, creating a new research ecosystem.

The recent rise in BIO token price is mainly due to the announcement of Bio Protocol’s first BioAgent (Aubrai) sale, which has sparked community participation enthusiasm and market expectations for ecosystem expansion. Users can participate in the sale by staking BioXP and investing BIO, while the upcoming listing of AUBRAI has further attracted speculative buying. The popularity of the DeSci sector and the optimistic sentiment around recent proposals have also contributed to the price increase.

M MemeCore (+3.31%, Market Cap $467 million)

According to Gate.io market data, the M token is currently priced at $0.44, with a 24-hour increase of 3.31%. MemeCore is an Ethereum Virtual Machine (EVM) compatible public chain that uses an innovative “Proof of Meme (PoM)” consensus mechanism to maintain network security. Users can delegate their meme coins to nodes for staking in a multi-chain environment, thereby enhancing network stability and receiving double block rewards. MemeCore is building the first Layer 1 blockchain designed specifically for meme coins, providing comprehensive infrastructure, security mechanisms, and incentive systems to support the next generation of meme-driven assets. It introduces a unique “Proof of Meme (PoM)” consensus mechanism, allowing users to stake meme coins to maintain network security, earn double rewards, and drive the development of a community-centric ecosystem.

The recent rise in M token price is mainly due to the high participation in the MemeX Liquidity Festival, which has attracted a large trading volume and triggered short-term liquidations. The enhanced Asian market strategy has boosted investor confidence, driving up speculative buying. The overall recovery of the altcoin market has also provided support for the price.

PLUME Plume (+0.96%, Market Cap $222 million)

According to Gate.io market data, the PLUME token is currently priced at $0.08, with a 24-hour increase of 0.96%. Plume is a fully integrated modular Layer 2 focused on RWAfi. They have built the first modular, composable EVM-compatible chain with a focus on RWA, aiming to simplify the tokenization of all types of assets through native infrastructure and chain-wide unified RWAfi-specific functions. Plume is building a composable DeFi ecosystem around RWAfis with an integrated end-to-end tokenization engine and a network of financial infrastructure partners for builders to plug and play.

The recent rise in Plume token price is mainly due to LayerBank launching Leverage Looping Vaults on its platform, and integration with NestCredit has improved the convenience and scalability of RWA yield strategies, attracting market attention. The high liquidity after Binance listing and the continued popularity of the RWA sector have further driven speculative buying.

Hotpot Insights

MetaMask Launches mUSD Stablecoin, Backed by Cash and Short-Term US Treasuries

MetaMask announced the launch of MetaMask USD (mUSD) stablecoin on the Ethereum chain. Ajay Mittal, VP of Product Strategy at MetaMask, stated: “MetaMask USD is fully backed by cash and short-term US Treasuries, which can generate yields. MetaMask benefits from this yield, which in turn allows us to improve the user experience across the entire stack, from potentially lower costs to more seamless integrations.”

MetaMask’s latest launch of a USD-pegged crypto asset marks an important step in advancing the practicality of digital assets and deepening user services. This move not only enhances the value stability within the platform’s ecosystem but also provides users with more reliable underlying financial support. By combining traditional financial instruments with decentralized services, the project further bridges the gap between real-world assets and the crypto ecosystem, making it possible to feed yields back into product experience optimization, thereby improving overall operational convenience and cost-effectiveness.

BenFen Public Chain Supports Rapid RWA Issuance, One-Click Onboarding for Various Physical Assets

BenFen, a stablecoin payment public chain, announced official support for one-click issuance and onboarding of RWA (Real World Assets) in a major version upgrade. This feature maintains a unified framework with the existing one-click stablecoin issuance, further refining BenFen’s position as a “stablecoin + RWA infrastructure public chain”. The new version optimizes the Move virtual machine and cross-chain engine, maintaining thousands of TPS and sub-second confirmation while providing underlying support for asset onboarding and compliant custody. Through built-in contracts and standardized processes, issuers can map real-world assets such as real estate, bonds, and stocks to on-chain tokens with one click, combined with custody, audit, and KYC processes to ensure secure mapping of off-chain assets to on-chain certificates.

BenFen public chain’s latest upgrade strengthens support for one-click onboarding and digitization of real-world assets, establishing its key position as a “stablecoin + RWA infrastructure” while maintaining high performance and enhancing compliance, security, and operational convenience. This progress will strongly promote the large-scale onboarding of real-world assets and the integration of DeFi with traditional finance, helping to build a more open and efficient global financial market. In the future, asset issuance and management models are expected to undergo fundamental changes, bringing investors richer low-barrier allocation options while also pushing the further development of blockchain compliance and cross-chain technologies.

Ethereum Foundation Launches Second Phase of “Trillion Dollar Security”

The Ethereum Foundation announced the launch of the second phase of its “Trillion Dollar Security” plan, focusing on improving wallet user experience. The plan involves enhancing wallet security, addressing blind signature issues, and establishing a vulnerability database to prevent smart contract exploitation.

The Ethereum Foundation’s new phase of the “Trillion Dollar Security” plan systematically addresses issues such as blind signatures and smart contract vulnerabilities, significantly enhancing wallet security and user experience, and driving blockchain infrastructure towards a more reliable and user-friendly direction. In the future, this progress will accelerate the attraction of mainstream users and promote the application of digital assets in everyday scenarios, while laying a critical trust foundation for the large-scale implementation of Web3 through security collaboration and standardization.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/trade/GT_USDT

- Gate, https://www.gate.com/price

- The Block, https://www.theblock.co/post/367713/metamask-musd-stablecoin-ethereum-linea-stripe-bridge

- Benfen, https://static.benfen.org/whitepaper/TokenIssues-zh.pdf

- X, https://x.com/Cointelegraph/status/1958408933053288622

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review