Gate Research: Lido's Share in Ethereum Staking Market Drops to 24.4% | Tether Announces Integration of Spark into WDK

Crypto Market Overview

BTC ( -4.04% | Current price 118,692 USDT)

BTC price dropped by 4.04% over the past 24 hours. After breaking a new high of $124,000, BTC quickly fell back to the range of $118,000 to $119,000. However, looking at the 1-hour MACD indicator, the short-term moving average has crossed above the long-term moving average, initially forming a golden cross. From technical indicators, BTC currently shows a divergent pattern of short-term overbought (RSI1:62.5), medium-term adjustment (RSI2:43.3), and long-term oversold (RSI3:17.3), indicating that the market is at a critical point of transition between bullish and bearish forces.

On August 14, BTC ETFs saw an outflow of $292 million, with ARKB accounting for $149 million and FBTC for $113 million.

ETH ( -3.04% | Current price 4,595 USDT)

ETH fell 3.04% over the past 24 hours. The decline is lower than that of Bitcoin and the median of Top100 altcoins, showing ETH’s recent price strength. Looking at the 1-hour MACD indicator, ETH’s short and long-term moving averages are also forming a golden cross trend, indicating continued bullish momentum in the short term, although momentum has weakened. The short-term RSI is 56.9, showing a neutral to slightly overbought sentiment.

On August 14, ETH ETFs saw an inflow of $119 million, with Fidelity and Grayscale’s ETF funds receiving inflows of $56.9 million and $60.7 million respectively.

GT ( +1.56% | Current price 17.91 USDT)

In the past 24 hours, the GT token price rose by about 1.5%, one of the few tokens that increased against the trend. Technical analysis indicators show that the 14-day Relative Strength Index (RSI) is over 60, approaching the overbought zone, indicating strong buying momentum but caution is needed for potential pullback risks. The MACD (12,26) shows neutral, suggesting the price may consolidate around the current level in the short term.

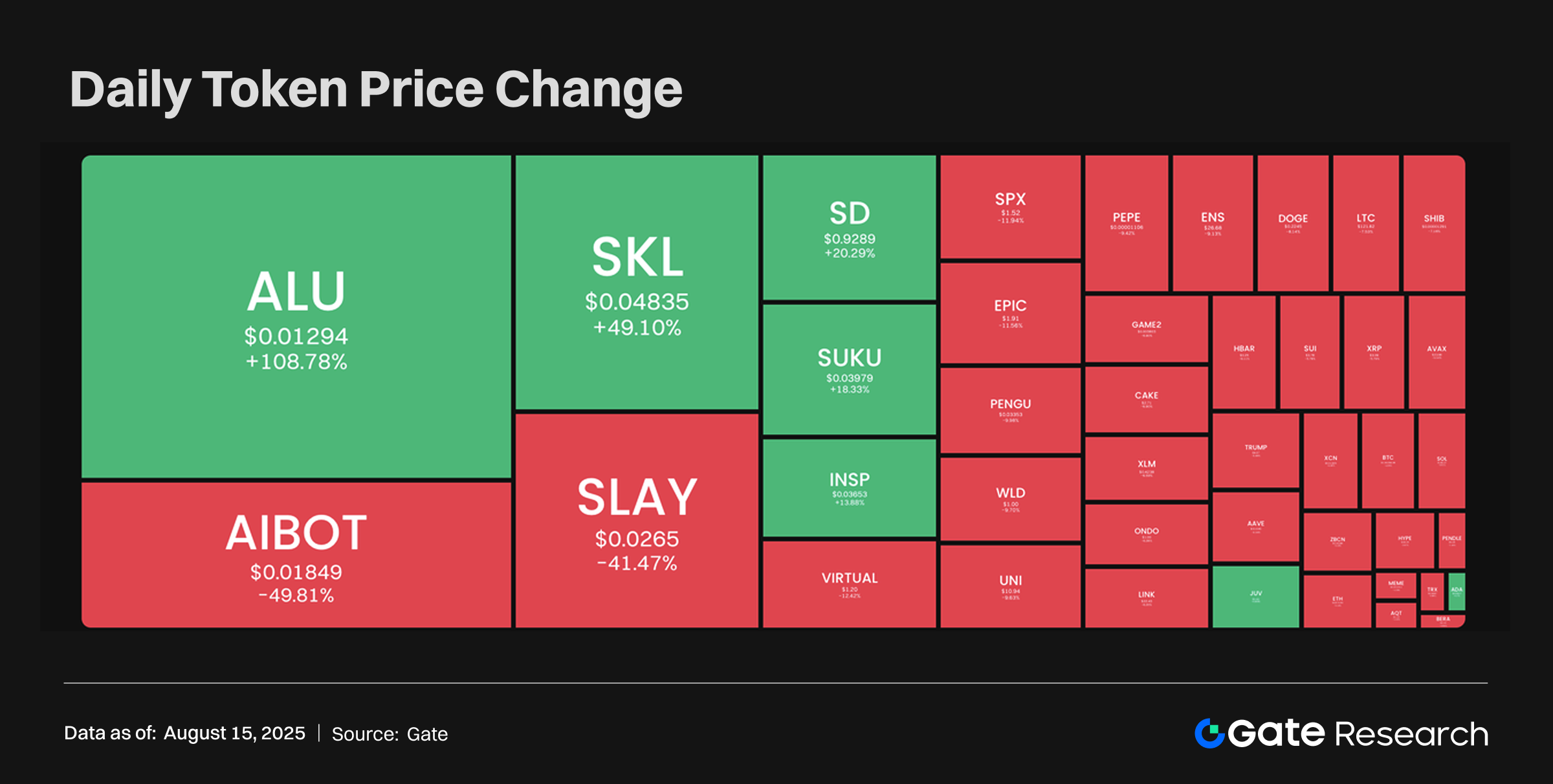

Tokens Heatmap

Most tokens experienced significant corrections yesterday after consecutive rises, with market sentiment declining. ALU led the market with a 108.76% increase, becoming the focus of attention; tokens such as CFX, PEPE, BONK, and TIA all dropped by more than 10%. Among the Top 100 tokens, none had gains exceeding 5% in the past 24 hours. In contrast, tokens like SKL, XNY, and CHEX rose by over 15%, becoming some of the few that increased against the trend.

SKL SKALE (+49.87%, Market Cap $283 million)

According to Gate.io data, the SKL token is currently priced at $0.047, with a 24-hour increase of 49.87%. SKALE is a decentralized network dedicated to providing scalable and secure infrastructure for deploying and developing decentralized applications. The project aims to address the scalability challenges faced by existing blockchain networks (such as Ethereum) using unique sidechain technology that enables high throughput and low transaction fees. With the increasing demand for decentralized applications, there is a more urgent need than ever for scalable and secure infrastructure solutions. The SKALE network is built on unique sidechain technology that can process transactions and smart contracts in parallel, enabling high throughput and low transaction fees. As a result, developers can create decentralized applications that can handle a large number of users and transactions, making them more accessible and usable for the mass market.

On August 12, “It Remains,” a Hollywood-level transmedia franchise project, was launched on the SKALE network. This integration utilizes SKALE’s gas-free, high-speed, EVM-compatible chains for interactive AR/VR experiences, NFTs that unlock story chapters, DAO governance through the $RESISTER token, and fan-driven narrative shaping. The project spans novels, games, collectibles, TV, film, and board games, with a 2024-2028 roadmap that has attracted over 120,000 fans and generated over $900,000 in revenue, increasing attention to the SKALE ecosystem. Possibly influenced by this, the SKL token price has risen 132% in the past 7 days.

XNY Codatta (+26.32%, Market Cap $147 million)

According to Gate.io data, the XNY token is currently priced at $0.017, with a 24-hour increase of 26.32%. Codatta (XNY) is a multi-chain, open, and decentralized data protocol dedicated to closely integrating Web3 data infrastructure with human contributors and AI expert agents. It not only provides a complete process for data submission, encrypted storage, validation, and assetization but also allows contributors to own the rights to data assets and continuously receive rewards through AI-driven applications, realizing knowledge digitization and monetization. This protocol operates through the XnY network, utilizing AI, automated economic incentives, and community verification mechanisms to achieve high data accuracy and verifiability. The ultimate goal is to establish a knowledge innovation engine driven by both humans and AI.

On August 14, Codatta partnered with Kite AI as the first data module in its ecosystem, leveraging Kite’s identity, payment, and governance architecture to enable a seamless decentralized AI data economy. Additionally, industry dialogues with Alibaba Cloud’s Qwen model, CARV, and other AI labs further enhanced Codatta’s utility in the AI and DeSci (Decentralized Science) fields, promoting data contributors to earn royalties through tokenized knowledge. This positive news may have driven the token’s price increase over the past 24 hours.

CHEX Chintai (+16.43%, Market Cap $181 million)

According to Gate.io data, the CHEX token is currently priced at $0.181, with a 24-hour increase of 16.43%. Chintai is a one-stop capital market modernization solution, regulated and licensed by the Monetary Authority of Singapore. The Chintai platform leverages blockchain technology to empower traditional financial and innovative enterprises, allowing them to harness the power of digital assets. The platform provides access to a powerful automated compliance engine powered by Chintai’s proprietary Sentinel-AI technology, offering end-to-end white-label solutions. Chintai’s product suite includes dynamic security token issuance, high-performance secondary trading, and automated compliance infrastructure for regulated digital assets, aimed at bridging the gap between enterprises and compliant blockchain technology through its Blockchain Platform as a Service (BPaaS) model.

Recently, multiple social media accounts on X revealed Chintai’s integration with Chainlink, including Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and data feeds, enhancing interoperability, transparency, and security in the RWA market. Although partly speculative, this development attracted investor attention, driving price rebounds and associating with Chainlink’s recent launch of real-time forex and precious metals pricing data. This positive news may have driven the token’s price increase over the past 24 hours.

Hotpot Insights

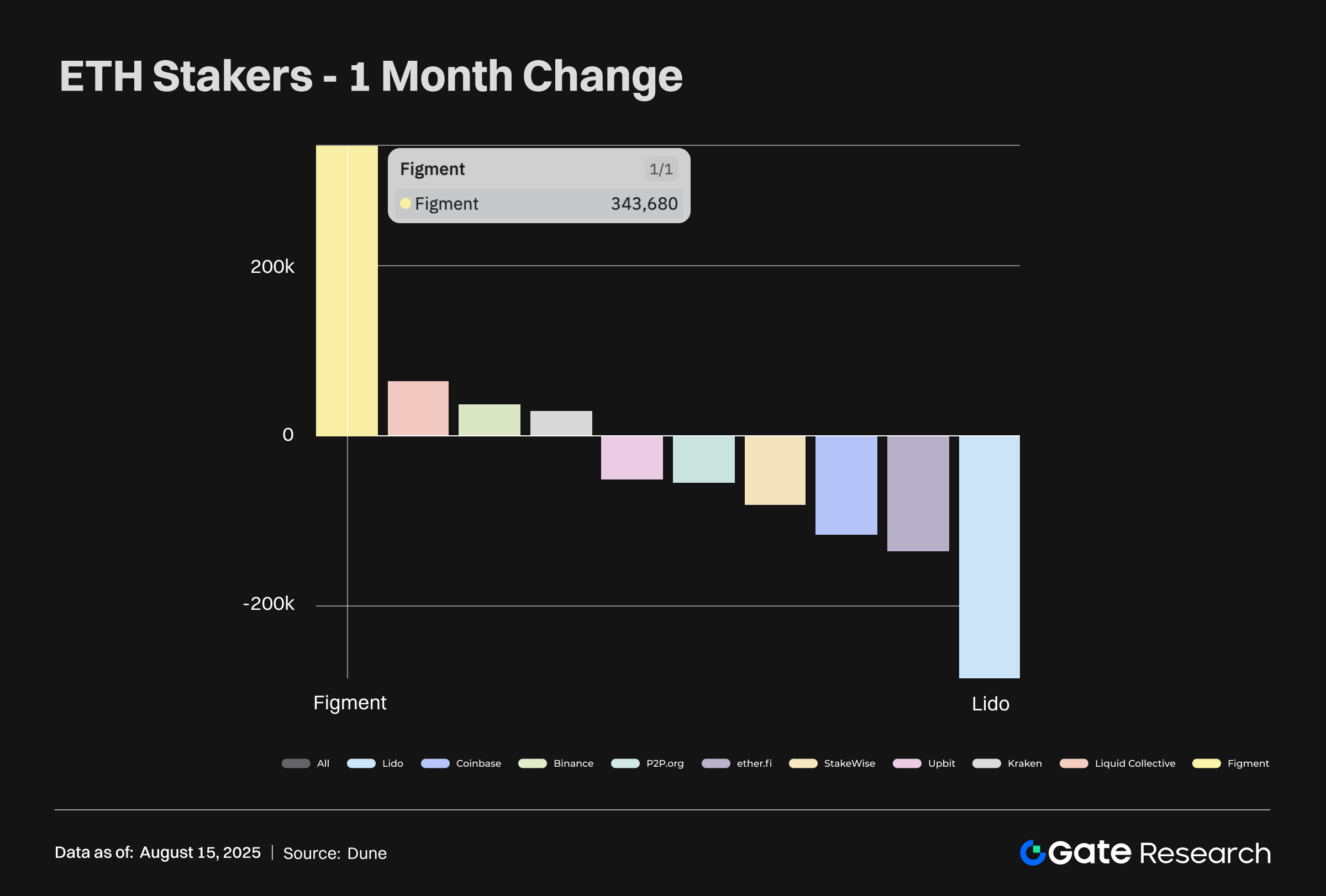

Lido’s share in Ethereum staking market drops to 24.4%, Figment adds the most new staking users in the past month

Lido’s share in the Ethereum staking market has dropped to 24.4%, a historical low. In contrast, Figment has added the most new staking users over the past month, with approximately 344,000 new staking users, now accounting for 4.5% of all staked ETH. This shift marks the maturation of the staking ecosystem. Lido, once seemingly unshakable, now faces multiple challenges from institutional-grade operators, community-driven decentralized protocols, and exchange staking products. For Ethereum, this diversification may signal an improvement in blockchain health. If this trend continues, the Ethereum staking market in 2025 may bid farewell to concerns about single service provider monopoly and enter a new stage of competition among specialized service models.

The shift in the Ethereum staking market landscape signifies that the ecosystem is moving towards a more mature stage - the significant decline in the market share of top service providers reflects that the risk of excessive concentration is easing, and the formation of a diversified competitive landscape will drive technological innovation and service upgrades. With the rise of different model participants such as institutional-grade operators, decentralized protocols, and trading platforms, the market is transitioning from single dominance to specialized segmented development. This more balanced ecological structure not only enhances the degree of network decentralization but also lays a healthier foundation for Ethereum’s long-term stable development.

Tether announces integration of Spark into WDK, supporting Lightning Network non-custodial financial infrastructure

Tether announced the integration of Spark into its open-source Wallet Development Kit (WDK), supporting Lightning Network non-custodial financial infrastructure. WDK is an open-source modular software development kit designed to empower businesses and developers to seamlessly integrate non-custodial wallets and user experiences for USD®, XAU®, and Bitcoin into any application, website, and device. Lightspark’s Bitcoin Lightning Network infrastructure provides enterprises with a complete toolchain for payment modernization, existing system integration, and new business scenario development, which highly aligns with Tether’s vision of building a financial system focused on privacy and permissionless innovation. This collaboration also demonstrates Tether’s commitment to supporting users in achieving seamless value transfer with emerging AI systems by providing powerful non-custodial tools.

This collaboration marks a significant advancement in the construction of open financial infrastructure. By deeply integrating cutting-edge decentralized payment network technology into open-source developer tools, it greatly lowers the barrier to building new types of wallet applications where users have autonomous control over their assets. It not only powerfully promotes the vision of a financial ecosystem that emphasizes privacy protection and permissionless innovation, but more crucially, it paves the way for future human-machine collaborative economic models. This move will accelerate the popularization of the next generation of programmable, censorship-resistant financial experiences.

Dinari to launch Layer 1 blockchain Dinari Financial Network

Dinari, a startup providing blockchain-based U.S. stock trading services, has announced the launch of its Layer 1 blockchain, Dinari Financial Network. Designed to serve as a coordination and settlement layer for securities issued on other networks like Arbitrum, the network is custom-built using Avalanche (AVAX) technology stack. The testnet is currently running, with plans for public release in the coming weeks.

Dinari’s launch of Dinari Financial Network, built on Avalanche technology, marks a new phase for blockchain securities trading. As a coordination and settlement layer specifically designed for security tokens, Dinari Financial Network will enhance cross-chain interoperability for networks like Arbitrum, improving trading efficiency and reducing settlement costs. The successful operation of the testnet demonstrates technical feasibility, and the public release in the coming weeks will provide a more compliant and transparent on-chain securities trading infrastructure for institutional and individual investors.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/trade/GT_USDT

- Gate, https://www.gate.com/price

- Dune, https://dune.com/queries/2394351/3928023

- Tether, https://tether.io/news/tether-integrates-spark-into-wdk-ushering-in-a-new-era-of-lightning-enabled-non-custodial-financial-infrastructure/

- X, https://x.com/GabeOtte/status/1955983085482414461

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review