Gate Research: Linea Launches Liquidity Incentive Program | BTC Rebounds to $111,398

Crypto Market Overview

BTC (-0.21% | Current Price 111,095 USDT)

After a significant pullback at the end of August, BTC found a bottom at $107,261 and rebounded to a high of $111,398. Currently, the price is consolidating around $111,000.

In terms of moving averages, MA5 and MA10 have moved back above MA30, forming a short-term golden cross, indicating a recovery in upward momentum. Trading volume significantly expanded during the rebound on September 2 but gradually declined afterward, suggesting limited willingness to chase above $111,000.

Key levels: $107,000–$107,500 remains a support zone; a break below may retest previous lows. Resistance is concentrated around $112,000–$113,000; a breakout with volume could target the previous high of $113,469.

Additionally, BTC ETFs saw a single-day net inflow of approximately $333 million on September 2, with Fidelity FBTC inflow of $132.7 million, BlackRock IBIT inflow of $72.86 million, and ARK 21Shares Bitcoin ETF (ARKB) inflow of $71.9 million.

ETH (-0.50% | Current Price 4,289 USDT)

ETH price has gradually fallen from a stage high of $4,956 to a low of $4,063. Recently, it has been oscillating in the $4,280–$4,300 range. Short-term moving averages (MA5, MA10) have crossed below MA30, indicating persistent bearish pressure.

Trading volume increased during the pullback, suggesting some support below, but rebound strength remains limited. If ETH can hold $4,280–$4,300, it may retest resistance at $4,360–$4,400; otherwise, a break below $4,280 could retest the previous low at $4,063.

Key short-term levels: support at $4,280, resistance at $4,360–$4,400; overall trend remains weak and oscillating.

Additionally, ETH ETFs experienced a net outflow of approximately $135.3 million on September 2, with BlackRock ETHA outflowing $99.2 million and Fidelity FETH outflowing $24.2 million.

GT (+0.03% | Current Price 16.84 USDT)

GT price dropped from a high of $19.37 to a low of $16.31, recently consolidating around $16.5–$17. Short-term moving averages (MA5, MA10, MA30) are converging, indicating a market in observation with direction yet to be determined.

Trading volume is generally low, only expanding during local dips or rapid rallies, indicating limited capital inflow. If GT stabilizes above $16.80–$17, it may retest resistance at $17.20–$17.50; otherwise, a drop below $16.50 could retest support at $16.30.

Key short-term levels: support at $16.50, resistance at $17.20–$17.50; consolidation is evident, with the breakout direction likely to determine the next trend.

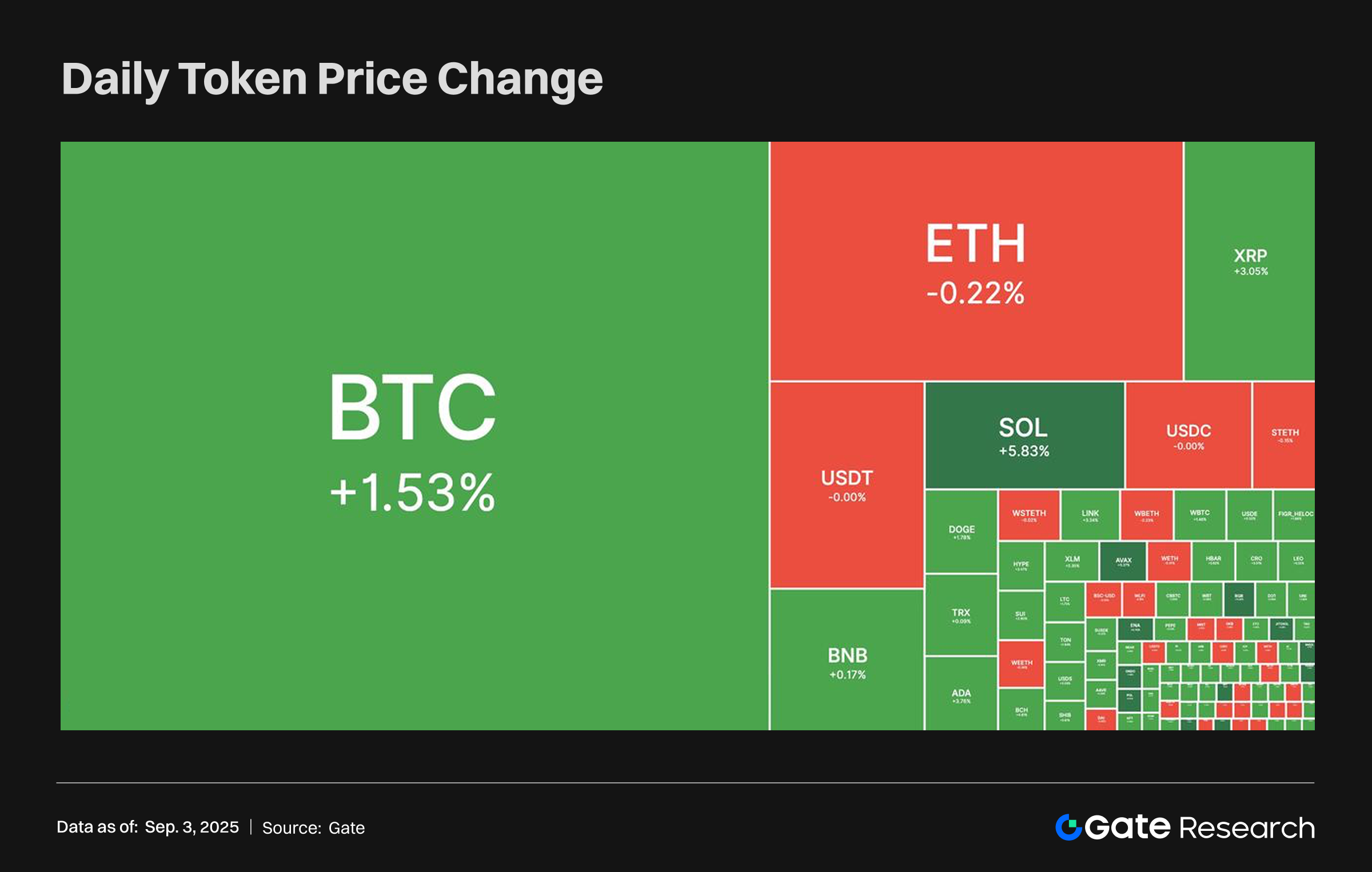

Tokens Heatmap

BTC reported 110,135.6 USDT, up 0.82% within the $107,471.9–$110,700 range, with short-term volatility risk remaining; ETH was at 4,387.55 USDT, up 1.69%, with on-chain active addresses reaching the highest since 2021, showing strong user engagement.

Although the overall market remains oscillating, some small-cap tokens still surged, indicating localized capital concentration. SQUID rose 102.54%, reflecting speculative sentiment; GMMT gained 67.16%, showing investor interest in emerging themes; MERL increased approximately 33.30%, boosted by ecosystem and cross-chain developments. Overall, risk appetite has not fully recovered, but structural opportunities and high volatility coexist.

SQUID - Squid Game (+102.54%, Market Cap $6.8M)

According to Gate market data, SQUID is currently priced at 0.009001 USDT, rising 102.54% in 24 hours. SQUID initially attracted attention due to the “Squid Game” narrative but has faced long-standing controversy. Squid Game is a meme token on Binance Smart Chain (BSC), inspired by the popular Netflix series. At launch, the project promised a play-to-earn game inspired by the show.

This surge is mainly driven by short-term speculative capital, social media hype, and community speculation, boosting buying sentiment. However, due to weak fundamentals, volatility is extremely high, and sustainability remains uncertain.

GMMT - Giant Mammoth (+67.16%, Market Cap $24.7M)

GMMT is currently priced at 0.009025 USDT, up 67.16% in 24 hours. It is a community-driven decentralized project focusing on Web3 applications and ecosystem partnerships, aiming to provide diversified crypto scenarios for users.

Recent promotion and new partnerships in Southeast Asia have significantly increased trading activity, with volume surpassing 17.84 million. Regional capital inflows further supported price growth.

MERL - Merlin Chain (+30.81%, Market Cap $125M)

MERL is priced at 0.1588 USDT, up 30.81% in 24 hours. Merlin Chain is a Bitcoin Layer-2 network designed to enhance BTC ecosystem scalability and support diverse applications, including DeFi, NFTs, and payments.

Recently, MERL gained attention due to an ecosystem incentive program, integration with multiple leading DApps, and M-BTC integration with the Sui network, enhancing BTC cross-chain liquidity. Mainnet upgrades, chain abstraction, AI-driven trading optimization, and upcoming BTC staking rewards further boosted ecosystem activity and user participation. As BTC narrative strengthens, Merlin Chain’s potential value has been highlighted, driving MERL price upward.

Daily Token Launch

New Token Sale Details

- Project: Moonchain

- Token: MCH

- Subscription Deadline: September 13, 2025, 12:00 (UTC)

- Participation: Stake ETH or MCH to claim for free

- Total Airdrop: 1,200,000 MCH

Project Introduction

Moonchain (MCH) is an AI value layer for data and zero-knowledge proof applications, supported by unique Initial Hardware Offering (IHO). With global device deployment, Moonchain converts real-world data into on-chain trustworthy and monetizable AI insights.

The project is backed by Citic Group, Dahua Bank, and JDI Ventures, aiming to build hardware-driven AI + Web3 infrastructure and expand the global data monetization ecosystem. MCH is positioned as a core backbone for AI + Web3, providing users and developers with reliable data, intelligent analysis, and on-chain value conversion opportunities.

Hotpot Insights

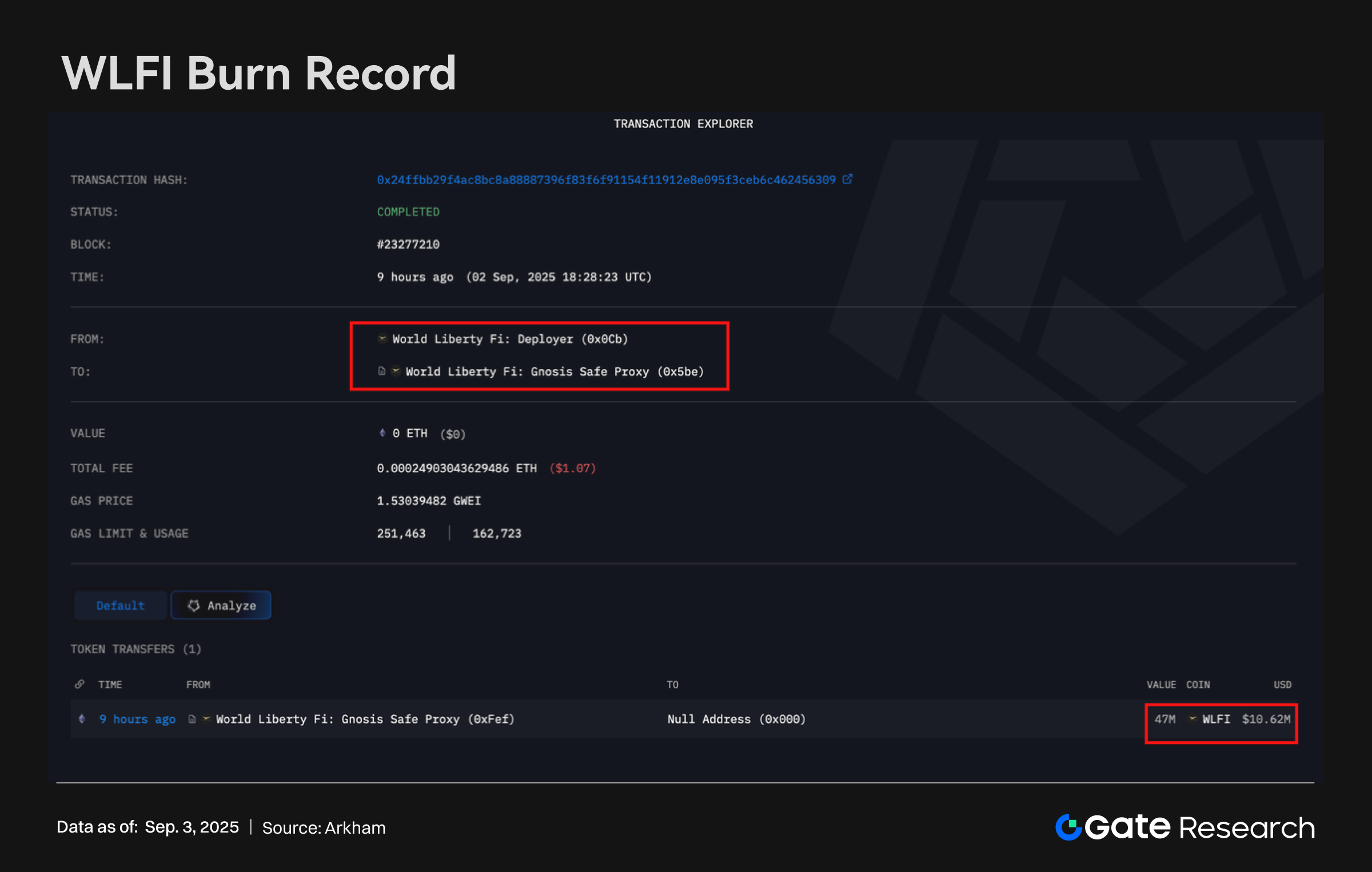

WLFI Buyback & Burn

On-chain data shows that WLFI recently burned 47 million WLFI (≈$11.34M) from unlocked treasury wallets within the last 6 hours, following community governance proposals. Previously, WLFI also repurchased 649,800 tokens with 2 million USD1 at an average price of $0.308 within two days after listing, further reducing circulating supply.

These measures demonstrate active supply management, potentially boosting short-term market confidence and providing a positive expectation for holders due to reduced circulating supply.

Linea Launches Liquidity Incentive Program

Linea officially announced the Linea Ignition liquidity incentive program with a total of 1 billion LINEA, targeting an additional $1B TVL. The program runs until October 26, 2025. The first batch of eligible partners includes Etherex, Aave, Euler, with Turtle Club to be added later. Distribution rules: 40% unlocks on October 27, the remaining 60% released linearly over 45 days.

Additionally, the Linea Association approved a 4% LINEA allocation to liquidity providers participating in Linea Surge. SBT-to-LINEA redemption details will be provided via a qualification check page.

This program helps increase TVL and liquidity activity for the Linea protocol, benefiting early ecosystem participants and likely boosting short-term market attention and trading activity.

Ethereum Foundation Sells ETH Again

On-chain monitoring shows the Ethereum Foundation transferred 10,000 ETH (≈$42.7M) to exchanges, planning to sell in the coming weeks to support R&D and donation activities. Previously, the foundation sold 10,000 ETH via OTC to SharpLink at an average price of $2,572/token, totaling $25.73M. This latest transfer occurred only 10 minutes before the official announcement.

While this sale may temporarily increase market supply and create short-term price volatility, it is primarily strategic capital deployment for ecosystem development and R&D, having limited long-term impact on market confidence.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/trade/GT_USDT

- Coingecko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Gate, https://www.gate.com/launchpool/MCH?pid=372

- X, https://x.com/EmberCN/status/1963032806357139556

- Arkham, https://intel.arkm.com/explorer/tx/0x24ffbb29f4ac8bc8a88887396f83f6f91154f11912e8e095f3ceb6c462456309

- Linea, https://linea.build/hub/events/linea-ignition

- X, https://x.com/LineaAssoc/status/1962992974733967570

- Arkham, https://intel.arkm.com/explorer/tx/0x7baebf33f47c96da9fd7617c4f6d09487a47f1881bdee161e62a56ad4943d61e

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review