Gate Research: Small-Cap Tokens Surge|Ethereum DEX Volume Hits Record High in August

Crypto Market Overview

BTC (-0.83% | Current Price: 108,196 USDT)

Recently, BTC faced resistance at the 113,469 USD high and dropped sharply, briefly breaking below 108,000 USD, with a low of 107,350 USD. On the moving averages, short-term MAs (MA5, MA10) have crossed below MA30, forming a bearish alignment, indicating continued short-term weakness. Trading volume increased noticeably during the decline, signaling strong selling pressure.

Currently, BTC is consolidating around 108,000 USD, a key support zone from prior lows. If this level fails to hold, the price could further test the 106,000–107,000 USD range. Conversely, a rebound would require BTC to reclaim MA30 (~108,700 USD) to restore the short-term trend. Key technical levels to watch are 107,000 USD support and 109,000 USD resistance; without sustained volume, downside risk remains.

On August 29, BTC ETFs saw a net outflow of 126 million USD, with BlackRock IBIT inflow of 24.6 million USD and Fidelity FBTC outflow of 66.2 million USD.

ETH (-0.78% | Current Price: 4,419 USDT)

ETH encountered resistance at the 4,646 USD high and pulled back to a low of 4,257 USD, before finding support and rebounding. Currently, ETH trades around 4,420 USD, with short-term MAs (MA5, MA10) just crossing below MA30, reflecting some retracement pressure.

Volume expanded significantly near the low, indicating buying support. If ETH holds above 4,400 USD, it may retest the 4,480–4,500 USD resistance zone. If it breaks 4,360 USD support, the prior low at 4,257 USD could be tested again. Short-term focus should be on 4,360 USD support and 4,500 USD resistance, as the consolidation pattern remains intact.

On August 29, ETH ETFs saw a net outflow of 164 million USD, with Fidelity FETH inflow of 51 million USD.

GT (-0.85% | Current Price: 16.85 USDT)

GT has been trading in a narrow range of 16.7–17.2 USD, with persistently low volume, reflecting cautious sentiment from both buyers and sellers. Currently at 16.85 USD, GT has repeatedly tested the 16.8 USD support; a confirmed break below could see a drop toward the previous low of 16.5 USD.

Moving averages (MA5, MA10, MA30) show a slight bearish alignment, indicating short-term weakness but limited downside. If GT can break above the 17.0–17.1 USD resistance with increased volume, a return to an upward channel is possible, targeting 17.3–17.5 USD.

Short-term focus remains on 16.8 USD support and 17.1 USD resistance. Overall, GT remains in a consolidation phase, and the trend direction is yet to be confirmed.

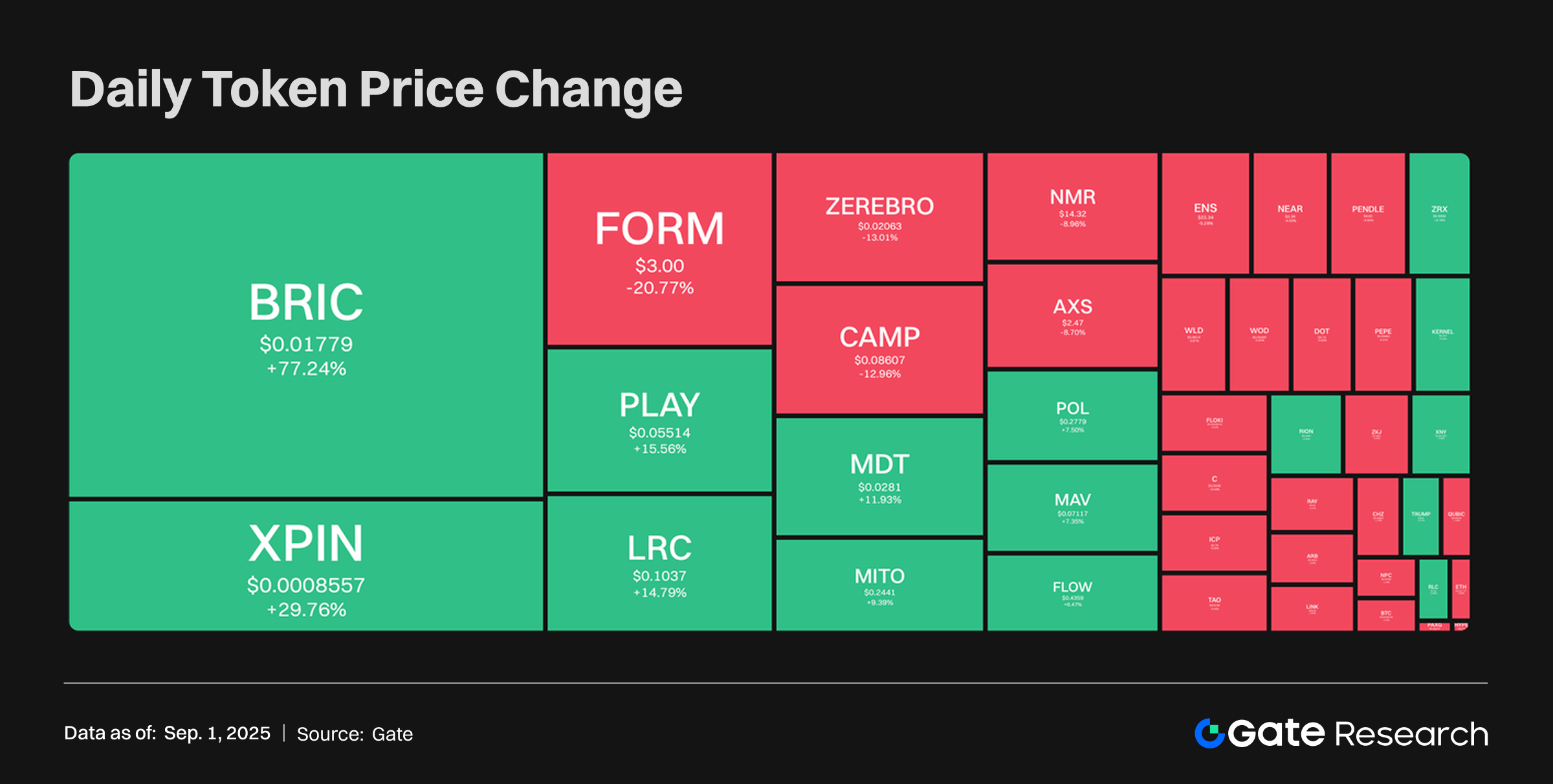

Tokens Heatmap

Despite the overall market entering a corrective phase, certain small-cap tokens have bucked the trend, showing concentrated capital inflows. BRIC led the pack with a 77.24% surge; XPIN also performed well, rising 29.76%. Other notable gainers included PLAY (+15.56%), LRC (+14.79%), and MDT (+11.93%). On the flip side, the market remains uneven. FORM fell 20.77%, leading the decliners, while CAMP and NMR each dropped over 8%, highlighting that market risk appetite has not fully returned, and structural opportunities coexist with high volatility.

BRIC – Redbrick (+77.24%, Market Cap: 4.31M USD)

According to Gate data, BRIC is currently priced at 0.017 USD, up 77.24% in 24 hours. Redbrick is an AI-driven Web3 content and game creation platform that leverages blockchain and AI to lower development barriers, enabling users to quickly create, publish, and monetize games and apps.

The recent surge in BRIC price is mainly due to the token being listed on a new exchange and the launch of an airdrop campaign. Additionally, the platform’s AI engine is set for an upgrade, further enhancing Redbrick’s prospects in the AI + Web3 gaming sector, driving significant investor interest.

MDT – Measurable Data Token (+11.93%, Market Cap: 16.78M USD)

According to Gate data, MDT is currently priced at 0.028 USD, rising 11.93% over the past 24 hours. MDT is a blockchain-based utility token supporting a decentralized data exchange ecosystem, enabling secure and anonymous data sharing and monetization between users, data providers, and buyers.

The price boost is primarily driven by its latest partnership with MaidenCentury. The IDEA platform can now directly access detailed transaction receipt data supported by MDT users, particularly in emerging markets. Preliminary data shows this fills gaps in spending data for platforms like Uber, Grab, and Zomato outside the U.S. and EU, and provides insights for multinational companies like McDonald’s tracking international revenue. The real-world application strengthens MDT’s value proposition and is a key driver for the price increase.

MITO – Mitosis (+9.39%, Market Cap: 45.81M USD)

According to Gate data, MITO is currently trading at 0.244 USD, up 9.39% in the past 24 hours. Mitosis is a liquidity protocol designed for the modular era, aiming to redefine cross-chain liquidity by enhancing LP attractiveness and yields, supporting the growth of the modular ecosystem. MITO, the native governance token, is used for liquidity aggregation, voting on fund allocation, and staking rewards.

The recent uptick is driven by the mainnet and dApp launch, combined with increased liquidity from new exchange listings. The protocol’s practical implementation and exchange expansion have jointly boosted market attention and buying momentum, pushing the token price higher.

Hotpot Insights

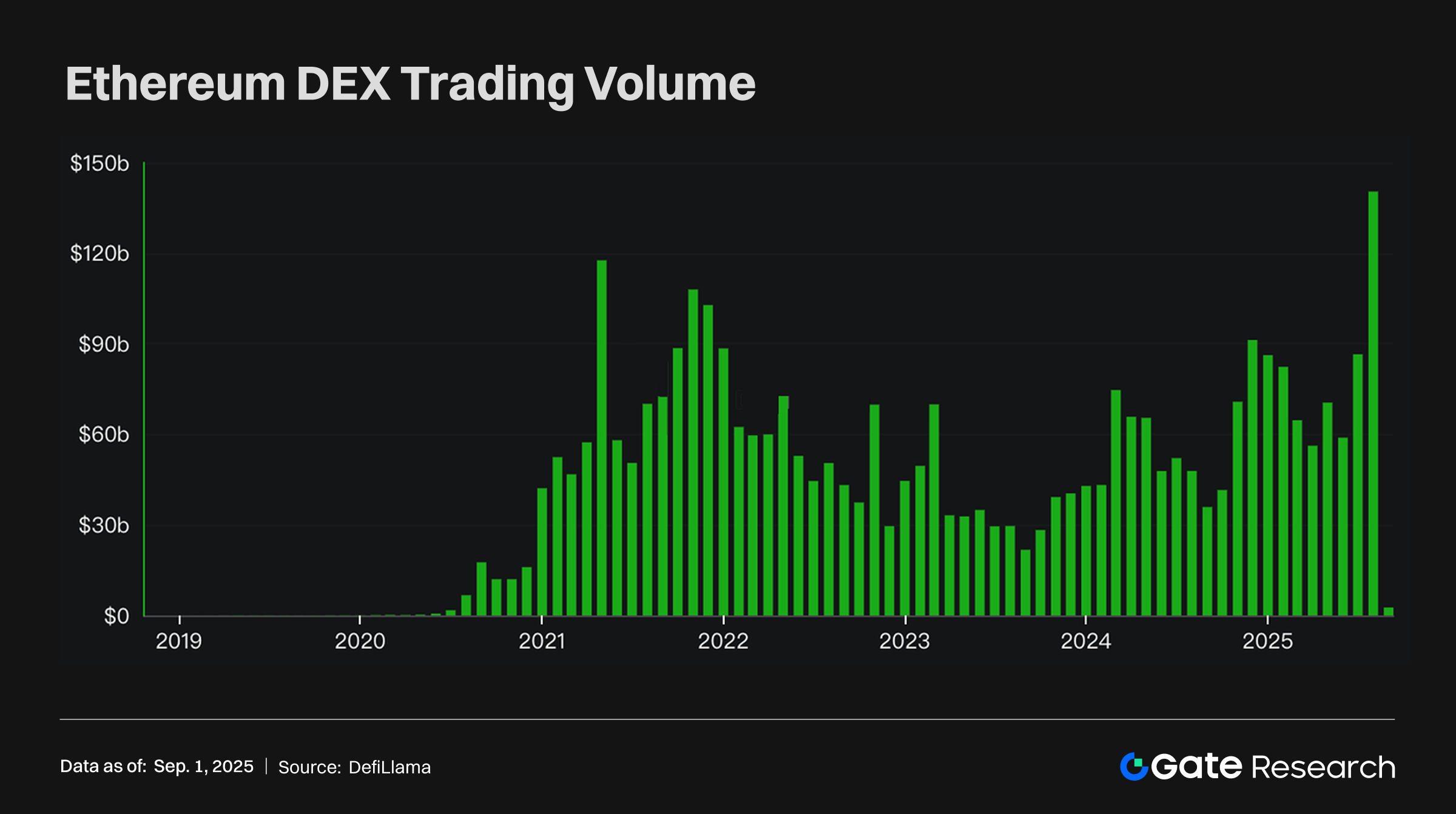

Ethereum On-Chain DEX Volume Surpasses $140.1B in August, Setting New Monthly Record

According to DefiLlama, in August 2025, Ethereum’s on-chain decentralized exchanges (DEXs) recorded a monthly trading volume exceeding $140.1 billion, breaking all previous records. Active addresses also reached 16.77 million, marking a new monthly high. Ethereum’s current TVL stands at $92.58 billion, still about 17% below the $108.8 billion peak at the end of the 2021 bull market.

Ethereum’s dual record for DEX trading volume and active addresses in August indicates a rapid recovery in ecosystem activity and capital liquidity. Although TVL has not fully returned to bull-market highs, record trading volumes show improved capital efficiency, with users favoring high-frequency trading and liquidity utilization rather than mere staking. This structure, where “trading activity > TVL recovery,” highlights Ethereum’s central role in the DeFi market and suggests that on-chain financial activity could see further expansion as L2 networks and emerging protocols accelerate.

Bonk.fun Partners with WLFI to Become Official USD1 Launchpad on Solana

Solana ecosystem launchpad Bonk.fun announced on X that it has partnered with WLFI, a crypto project associated with the Trump family, to become the official Launchpad for the USD1 stablecoin on Solana. Details on the listing schedule and strategic implications will be announced later.

This collaboration introduces USD1 into Solana’s ecosystem for issuance and promotion, further strengthening Solana’s stablecoin and application-layer infrastructure. Leveraging Bonk.fun’s traffic and ecosystem resources could accelerate USD1 adoption, expand its use cases, and enhance liquidity on Solana. Strategically, such partnerships not only bolster Solana’s financial infrastructure but may also drive secondary growth in ecosystem applications. However, USD1’s compliance, market acceptance, and circulation scale will require ongoing observation.

Japan Post Bank Plans to Launch Digital Currency in 2026, Supporting Blockchain-Based Financial Products

Japan Post Bank intends to launch its own digital currency in 2026 and explore enabling users to transact blockchain-derived financial products, including security tokens and NFTs. As one of Japan’s largest financial institutions, this initiative could become a key milestone in integrating blockchain with traditional finance.

The plan signals a gradual alignment of Japan’s financial system with digital assets and blockchain finance. Unlike private stablecoins or Web3 projects, bank-led digital currencies offer higher compliance and credibility, potentially providing more robust settlement and trading channels for security tokens, NFTs, and other emerging assets. If successfully implemented, it could significantly advance the regulated and scaled development of Japan’s digital asset market, while accelerating the digitization of financial products. At the same time, attention will be needed on its positioning relative to the central bank digital currency (CBDC) and how to balance innovation with regulatory compliance.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/trade/GT_USDT

- Gate, https://www.gate.com/price

- DefiLlama, https://defillama.com/chain/ethereum?activeAddresses=false&tvl=false&groupBy=monthly&dexsVolume=true

- X, https://x.com/bonk_fun/status/1962350097330503828

- X, https://x.com/zoomerfied/status/1962176764383297741

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review