Gate Research: The Crypto Market Enters Broad Downward Adjustment|Solana Leads Public Chains in Fee Stability

Crypto Market Overview

BTC (-2.37% | Current Price: 113,003 USDT)

BTC remains in a downward consolidation trend, with moving averages forming a bearish alignment, indicating continued short-term weakness. On the MACD indicator, both signal lines are trending downward, reinforcing the bearish outlook. Trading volume has not shown significant expansion, limiting rebound momentum. Overall, BTC is still in a weak structure in the short term. Key support to watch is 112,500 USDT; if a rebound occurs, 114,000 USDT will be the first resistance level.

ETH (-4.26% | Current Price: 4,111 USDT)

ETH is also showing weakness, with price trading below short-term moving averages, signaling that the downtrend remains intact. MACD shows ongoing bearish momentum—while the fast and slow lines are close, no crossover has occurred, and the red bars have turned green without a clear recovery. Volume remains moderately low, indicating limited buyer participation.

GT (-3.78% | Current Price: 16.576 USDT)

GT continues to trend downward, with short-term performance remaining weak. Moving averages are in a bearish formation, underscoring the prevailing downtrend. The MACD remains in bearish territory, with the signal lines diverging downward and green bars expanding again—no sign of reversal yet. If the price can hold above 16.30 USDT with decreasing volume, a consolidation phase may follow. However, if the decline continues with rising volume, further downside toward 16.00 USDT or lower support zones may occur.

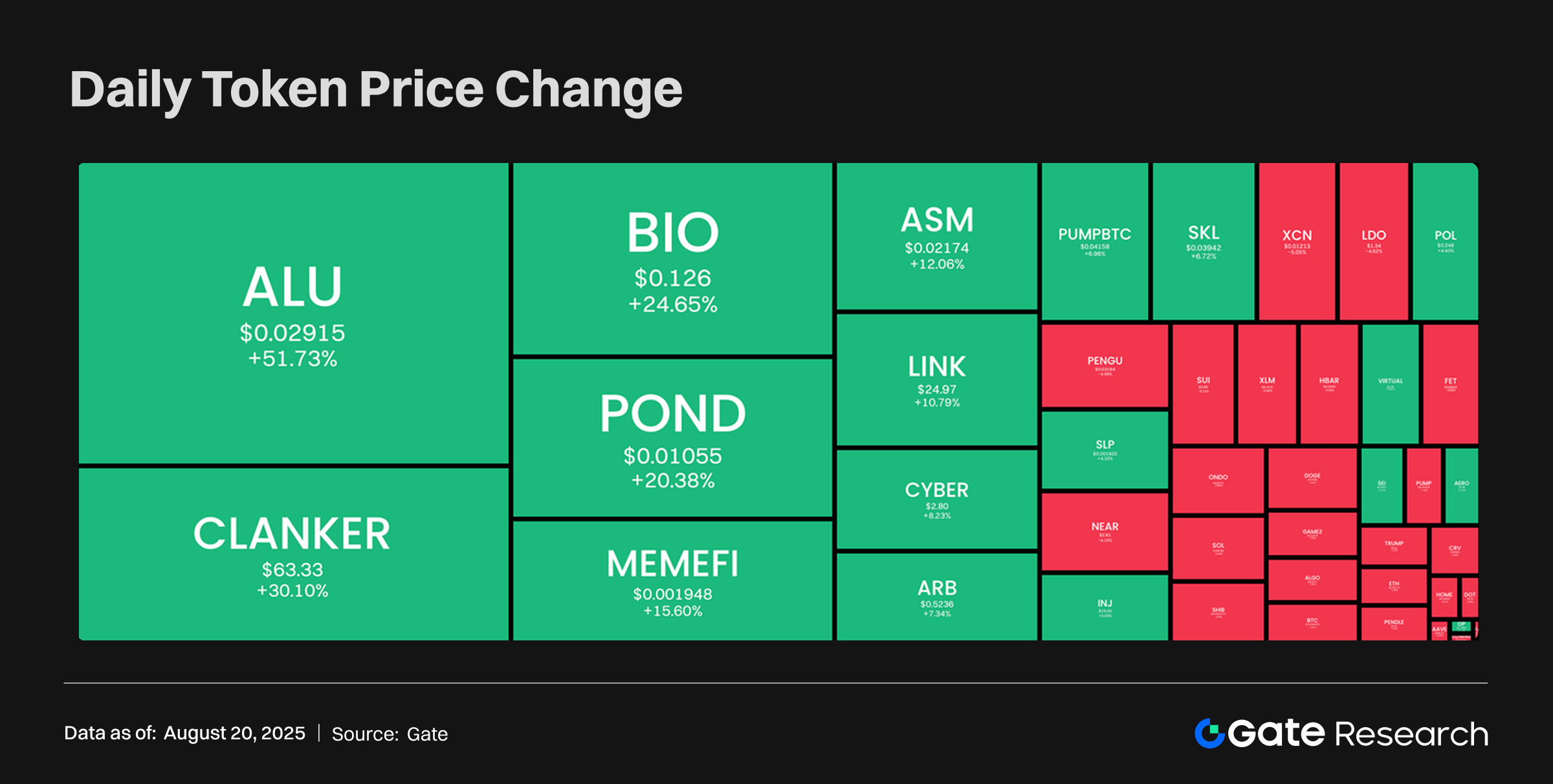

Tokens Heatmap

Most tokens showed divergent performance, with the overall market remaining weak and capital flow appearing cautious yet selectively active. API3 led the gains with a remarkable 50.78% surge, becoming the standout performer of the session. Other tokens such as BRISE, OGN, and RAD also posted double-digit gains, attracting increased market attention.

In contrast, major assets like ETH, ADA, XRP, and APT saw widespread declines, indicating persistent short-term correction pressure and a shift in investor focus toward small- to mid-cap tokens in search of opportunities.

MNT Mantle(+6.21%, Circulating Market Cap: $4.539 Billion)

According to Gate market data, the MNT token is currently priced at $1.3555, with a 24-hour gain of approximately 6.21%. Mantle is a modular blockchain ecosystem supported by Layer 2 infrastructure, aiming to bridge liquidity between DeFi and CeFi. Its native token, MNT, serves multiple functions including governance, gas payments, staking, and ecosystem incentives. The Mantle economic model continuously optimizes token circulation and utility.

The recent price increase in MNT is likely driven by multiple ecosystem catalysts, including the upcoming launch of perpetual contracts, improved collateral efficiency across various lending platforms, and a $250,000 puzzle-based campaign that has boosted community engagement—helping MNT show relative strength despite broader market pullbacks.

LDO Lido DAO Token(+0.79%, Circulating Market Cap: $1.159 Billion)

According to Gate market data, LDO is trading at $1.2925, up approximately 0.79% in the last 24 hours. Lido is the largest liquid staking protocol in the Ethereum ecosystem, allowing users to stake ETH for PoS validation while receiving stETH in return—enabling both liquidity and staking rewards. The native LDO token is used for governance, voting on proposals, and distributing ecosystem incentives.

LDO’s recent upward movement is supported by several positive developments: the TVL of stETH across multiple chains has surpassed $1 billion, reflecting growing demand for liquid staking. Additionally, Lido has released an institutional staking framework and continues to push forward with upgrades like Distributed Validator Technology (DVT) and decentralized governance enhancements—reinforcing its dominance in the Ethereum staking landscape.

MORPHO Morpho Labs(+2.50%, Circulating Market Cap: $667 Million)

According to Gate market data, MORPHO token is currently priced at $2.0359, with a 24-hour increase of 2.50%. Morpho is a DeFi protocol focused on improving on-chain lending efficiency through a hybrid Peer-to-Pool and Peer-to-Peer model. Its native token, MORPHO, is used for governance, ecosystem incentives, and protocol development.

Recent gains in MORPHO may be attributed to multiple ecosystem advancements, including integration with Ledger Live (offering up to 7.5% on-chain yield), the launch of multi-asset yield vaults in partnership with Bitpanda, and the introduction of institutional-grade risk-adjusted returns through collaboration with Gauntlet. Ongoing UX improvements have also helped increase visibility and user engagement.

Hotpot Insights

Wyoming Launches FRNT Stablecoin, Pioneering State-Issued Digital Currency in the U.S.

The U.S. state of Wyoming has officially launched the Frontier Stable Token (FRNT), becoming the first state-level government entity in the country to issue its own stablecoin. Backed by U.S. dollars and short-term Treasury bonds, FRNT emphasizes high transparency and fiat-pegged stability. It is currently deployed across seven major blockchains—Ethereum, Solana, Arbitrum, Avalanche, Polygon, Optimism, and Base—demonstrating a bold ambition for cross-chain integration and ecosystem compatibility.

However, due to the lack of clear federal-level regulatory frameworks, FRNT is not yet available to the public and is currently limited to specific institutional and use-case scenarios.

The launch of FRNT marks a new frontier in crypto finance for state governments, highlighting how U.S. local governments are increasingly asserting autonomy in digital asset policymaking. Wyoming has long been one of the most crypto-friendly states in the U.S., and this move may serve as a key case study for “public sector-issued stablecoins.” If federal regulatory clarity improves in the future, FRNT could play a meaningful role in applications such as payments, settlements, and public accounts—and potentially become a model for other states to follow.

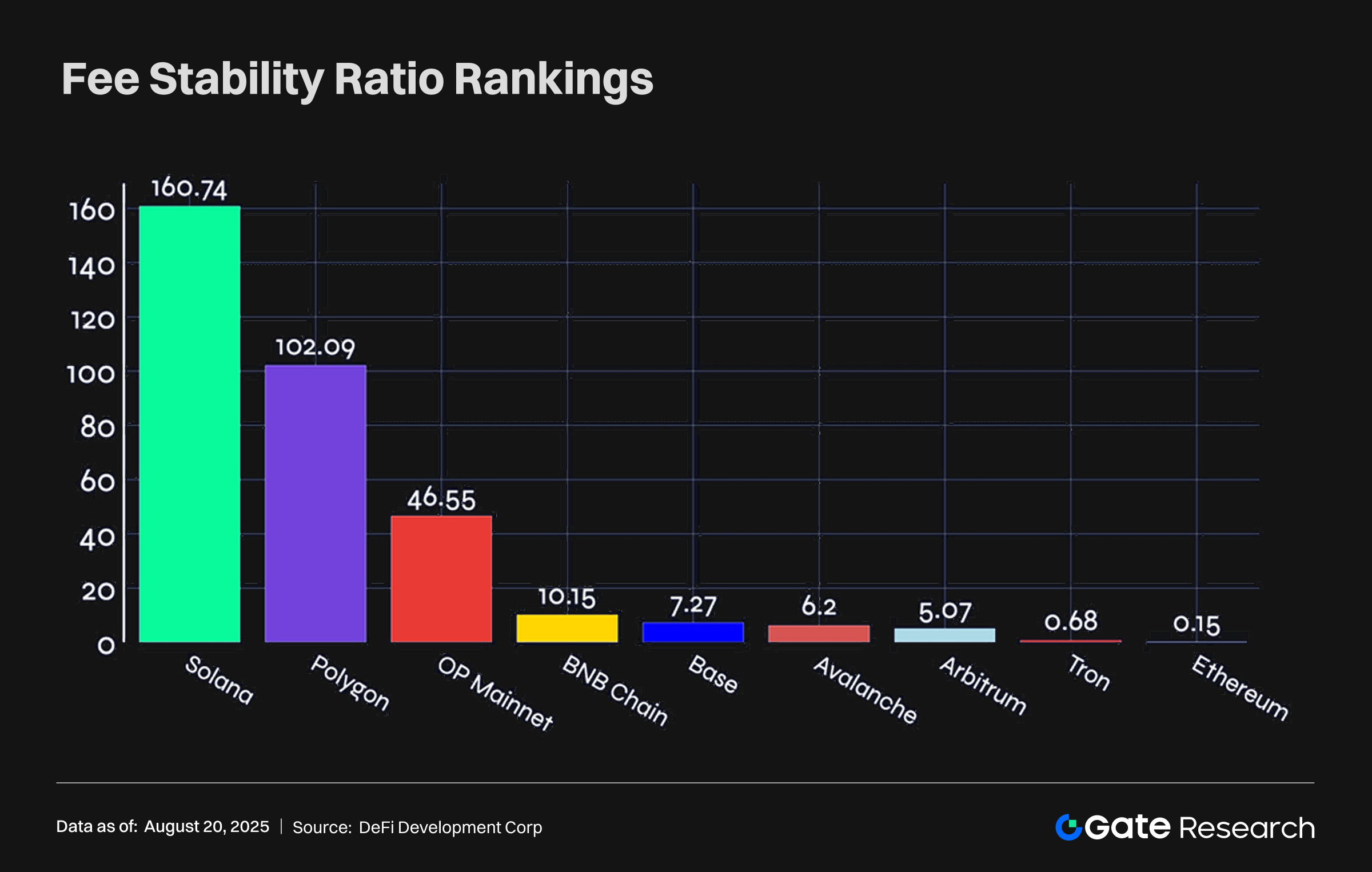

Solana Leads Global Blockchain Networks in Fee Stability, Tops FSR Ranking

According to the latest Fee Stability Ratio (FSR) report from DeFi Development Corp., Solana ranks No.1 globally with an FSR score of 160.74—making it the most stable and cost-effective blockchain network for transaction fees. The FSR is calculated as “1 ÷ (median transaction fee × fee volatility),” where a higher value indicates cheaper and more stable fees, benefiting both users and dApp developers. Solana boasts a median fee of just $0.0012 with extremely low volatility, ensuring long-term viability for high-frequency applications.

By comparison, Ethereum, despite being a major Layer 1 chain, ranks last with an FSR of just 0.15 due to high and unstable gas fees.

Other notable performers include Polygon (FSR 102.09) and OP Mainnet (46.55), which also offer strong low-cost advantages. Avalanche and Arbitrum, while offering relatively cheap fees, score lower due to higher volatility. Tron, with high fees around $4.77 but low volatility, only earns 0.68 points.

The FSR ranking underscores that low and predictable transaction fees are critical to scaling on-chain applications. Solana’s strong performance not only reflects its technical efficiency but also positions it as ideal infrastructure for DePIN, blockchain gaming, and payment applications that demand high transaction throughput.

1inch Integrates Native Cross-Chain Swaps Between Solana and EVM Networks, Redefining UX and Security

Decentralized exchange aggregator 1inch has introduced a major upgrade: native cross-chain asset swaps between Solana and multiple EVM-compatible chains such as Ethereum and Polygon—without relying on traditional cross-chain bridges.

Users can now swap assets directly across chains without additional bridging steps, significantly reducing operational complexity and transfer friction. The new feature is integrated into the 1inch dApp, mobile wallet, and Fusion+ API, and includes built-in protection against MEV (Maximal Extractable Value) attacks to reduce risks from frontrunning.

Traditional cross-chain bridges have frequently been exploited due to technical vulnerabilities, resulting in massive losses. 1inch’s “native swap” approach bypasses these bridge-related risks, enhancing user asset security and improving liquidity flow between the Solana and Ethereum ecosystems.

The feature can be integrated by developers into new projects, while regular users can access it via mobile or web interfaces. 1inch also plans to expand support to more blockchain networks in the future, aiming to enhance cross-chain interoperability and asset efficiency at a higher level.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/trade/GT_USDT

- Gate, https://www.gate.com/price

- X, https://x.com/EleanorTerrett/status/1957763504435524055

- X, https://x.com/defidevcorp/status/1957791134748668384

- The Block, https://www.theblock.co/post/367406/1inch-launches-native-swaps-between-solana-and-evm-chains

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review