What is Velora (VLR)?

What Is Velora?

(Source: docs.velora)

Velora (VLR) operates as a DeFi middleware, unifying multiple liquidity sources through a comprehensive interface and API to deliver faster, more efficient trading and an enhanced user experience. Formerly known as ParaSwap, Velora’s evolution reflects the maturation of DeFi aggregators. The introduction of the VLR governance token has reinforced Velora’s leadership among aggregation protocols, establishing it as a key component for trading and infrastructure in multi-chain ecosystems.

Core Positioning of Velora

Velora’s mission is to minimize friction for traders and maximize liquidity utilization. Leveraging advanced path analysis and multi-path order splitting, Velora automatically identifies optimal exchange rates and simplifies complex transactions into a single step. Its core features include:

- High-Efficiency DEX Aggregation: Simultaneously scans hundreds of liquidity sources to secure the most competitive rates.

- Smart Order Splitting & Multi-Path Trading: Automatically divides large orders among multiple liquidity pools to reduce slippage risk.

- Cross-Protocol Operations: Enables one-click interactions across platforms, such as swapping ETH for DAI and instantly depositing into Aave, reducing both time and gas costs.

- Gas Optimization: Integrates gas cost considerations within route selection to maximize users’ net returns.

- Private Market Maker Network: Incorporates the Augustus RFQ protocol to offer MEV-resistant, low-slippage quoting and execution.

These innovations elevate DeFi’s accessibility, benefiting both high-volume traders and everyday users.

Cross-Chain and Gasless Trading: A New DeFi Experience

Velora Delta is the platform’s latest smart contract suite, built on the Portikus Intents Network and now live on Ethereum, Base, and Optimism. This next-generation aggregator architecture features:

- Cross-Chain Transactions: Users can seamlessly express intent across networks (for example, swapping Base USDC for Optimism USDC) without manual bridging or needing the target chain’s gas token.

- Competitive Pricing: Agents compete in auctions to deliver the best price for users.

- Gas Fee Abstraction: No gas fees are required from users at transaction submission—authorize the token; agents handle execution and costs.

- Minimized MEV Risk: Agent competition and optimal execution significantly reduce sandwich attacks and price manipulation threats.

- Smooth User Experience: Velora’s intuitive interface streamlines cross-chain operations into a simple workflow.

Delta’s process involves three steps:

- Order Forwarding: User-submitted orders are sent to the Portikus network.

- Agent Auction: Portikus hosts an auction where agents compete for execution rights.

- Contract Execution: The winning agent invokes the Velora Delta smart contract to complete the transaction.

Velora Delta sets a new industry standard for DeFi aggregation, blending cross-chain capabilities, gasless execution, and best-price fulfillment.

Velora Limit Order Protocol

Beyond aggregation and cross-chain functionality, Velora has introduced a multi-chain limit order protocol on Ethereum, Polygon, BSC, Avalanche, Arbitrum, and Optimism. Key features include:

- Broad Asset Support: Compatible with ERC-20 tokens and ERC-721 NFTs, enabling token-for-NFT and NFT-for-NFT swaps under limit order logic.

- Superior Gas Efficiency: Delivers best-in-class gas performance compared to peer limit order protocols.

- Enhanced Flexibility: Users can freely specify counterparties’ payment assets for greater composability and choice.

Developers can build dApps and expand the utility of DeFi and NFTs using Velora’s protocol, which serves as both a trading tool and foundational DeFi infrastructure.

Revenue Model

Velora’s principal revenue streams include:

- Swap Fees: Partners integrating Velora may opt to charge fees. Via the Augustus protocol, the Velora DAO collects 15% of total swap fees; transactions executed through Delta are subject to a revenue share only for profitable outcomes.

- Surplus Value Capture: Favorable market fluctuations can generate surplus value, which is collected by the DAO and reinvested into protocol growth and sustainability. Specifically, 100% of surplus is collected under the Market model, and 50% under the Delta model.

Tokenomics

Velora’s native token VLR is the platform’s governance and staking asset, rewarding both users and the community. VLR replaces the PSP token at a 1:1 exchange rate, with a capped supply of 2 billion. Its functions include:

- Governance: VLR holders can vote on protocol parameters, fee structure, and strategic direction.

- Staking & Incentives: VLR staking enables participants to share in protocol fees and receive DAO rewards.

- Cross-Chain Rewards: Stakers earn proportional returns from gas tokens across all chains where Velora is deployed.

Additionally, Velora allocates 80% of protocol fees to stakers, with the remaining 20% going to the DAO treasury to support ongoing ecosystem development.

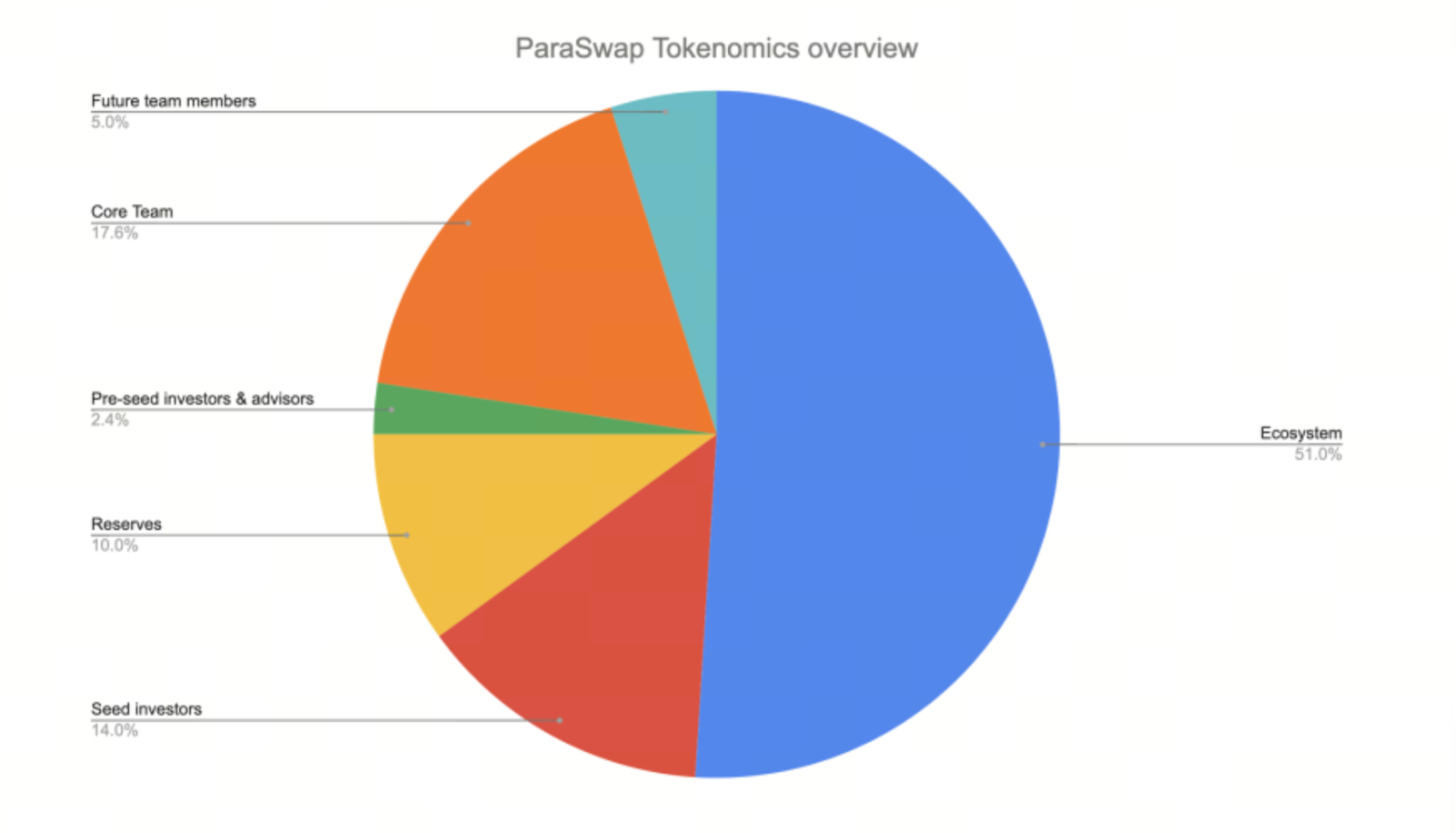

Token Allocation

VLR’s initial distribution prioritizes the community, development, and sustainable ecosystem growth:

- Future Team Members (5%): Reserved for strategic future hires.

- Core Team (17.6%): Supporting long-term protocol development and operations.

- Pre-Seed Investors & Advisors (2.4%): Rewarding early supporters.

- Ecosystem (51%): Supporting dApp development, partnerships, and core infrastructure.

- Reserves (10%): Ensuring the protocol’s long-term stability.

- Seed Investors (14%): Providing early-stage funding.

(Source: docs.velora)

This strategic allocation balances community-driven growth, team incentives, and ecosystem expansion, ensuring Velora’s continued decentralized development.

You can start spot trading VLR here: https://www.gate.com/trade/VLR_USDT

Conclusion

Velora (VLR) is far more than an aggregator—it’s a comprehensive DeFi infrastructure platform, integrating DEX aggregation, cross-chain gasless trading, limit order protocols, and private market-making. It empowers users with best-price execution at minimum cost, transcends single-chain limitations, and delivers a true one-stop DeFi experience. As the VLR token launches and governance mechanisms mature, Velora will keep advancing the user experience and remain an essential middleware for the DeFi ecosystem.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality