Lesson 4

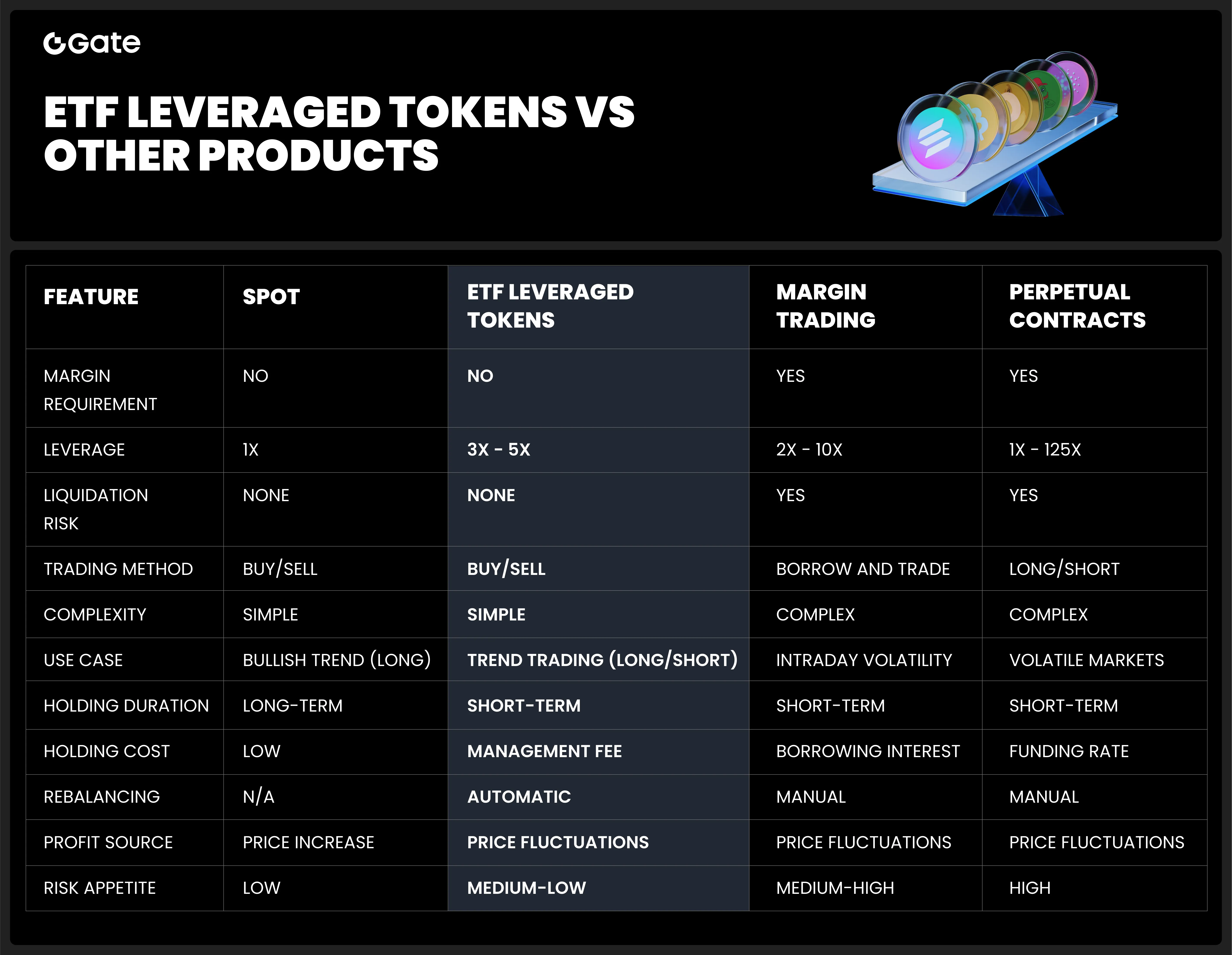

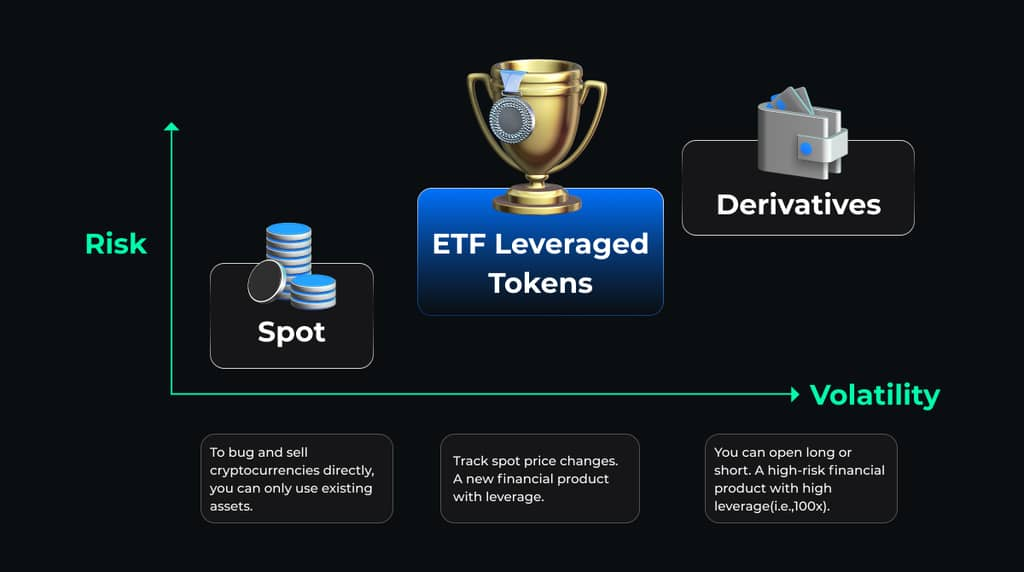

How Do ETF Leveraged Tokens Differ from Spot, Margin, and Futures Trading?

Compare ETF leveraged tokens with traditional trading methods to understand their unique features.

- Spot Trading: Users buy and sell cryptocurrencies using fiat or stablecoins (e.g., USDT) and immediately receive ownership of the asset.

- Margin Trading: Users borrow funds to amplify their position size, increasing both potential gains and losses. Leverage is determined by the borrowed amount relative to the user’s collateral.

- Futures Trading: Users trade derivative contracts with leverage, which dynamically adjusts based on position value. High leverage increases the risk of liquidation if the margin is insufficient.

- ETF Leveraged Tokens: These tokens have built-in leverage, amplifying asset price movements without requiring margin or borrowing. Users can trade them like spot assets without worrying about liquidation.

Performance Comparison: Spot, Futures, and ETF Leveraged Tokens in Different Market Conditions

Disclaimer

This is not investment advice. This information is provided for informational purposes only and should not be construed as a recommendation to buy, sell or hold any asset. Cryptocurrency trading involves a risk of loss.

Gate US services may be restricted in certain jurisdictions. For more information, please see our legal disclosures: https://us.gate.com/legal/disclosures

Catalog

Lesson 1:ETF Leveraged Tokens Introduction

03 min

0 enrolled

Lesson 2:Pros and Cons of ETF Leveraged Tokens

0 enrolled

Lesson 3:What market conditions are ETF leveraged Tokens suitable for?

0 enrolled

Lesson 4:How Do ETF Leveraged Tokens Differ from Spot, Margin, and Futures Trading?

0 enrolled

Lesson 5:How to trade ETF leveraged tokens?

0 enrolled