XRP Price Ready to Surge: Why $15 Is the Next Target

Overview: XRP Price Surges Past Key Resistance, Eyes $15 Target

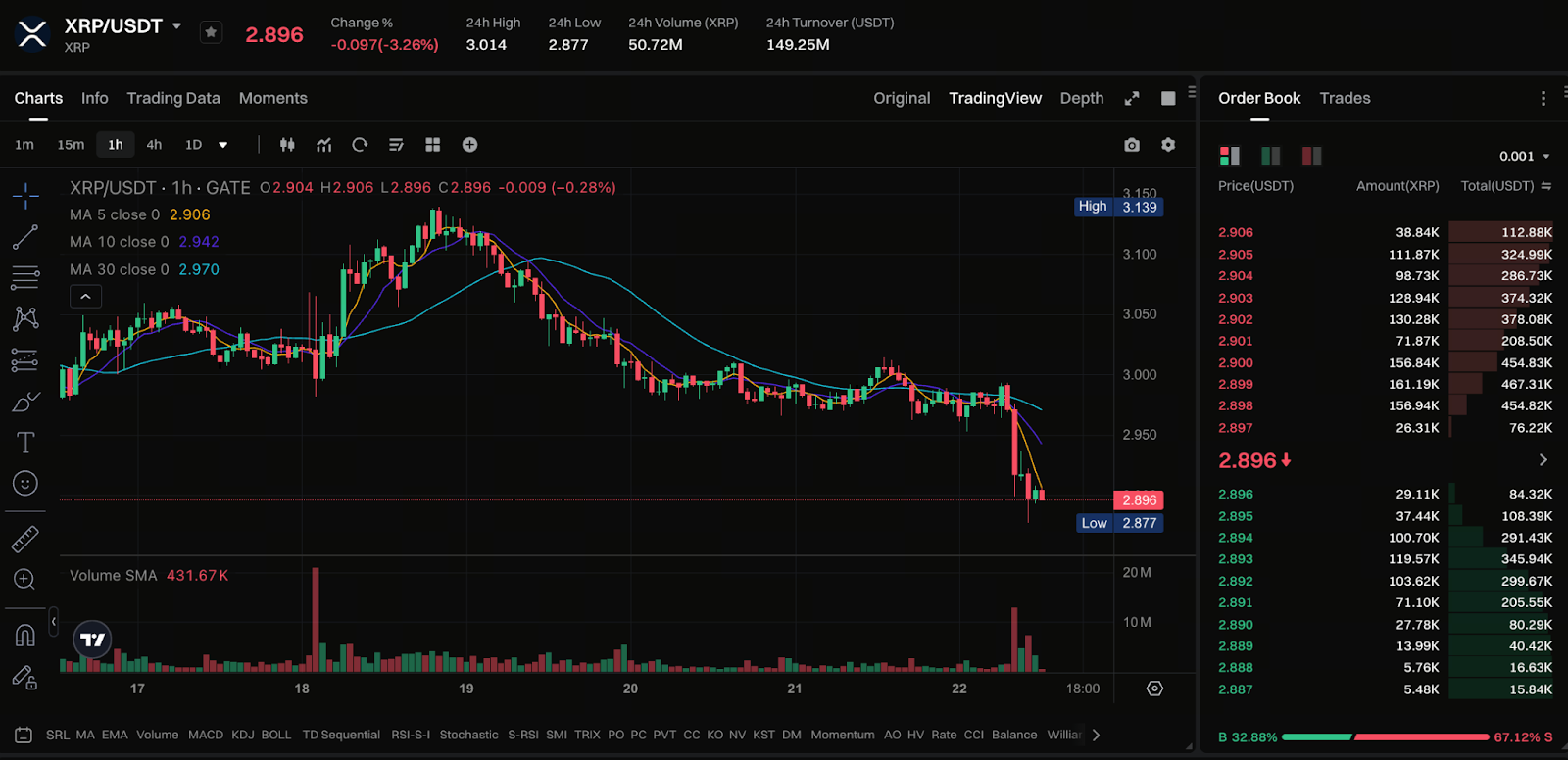

Chart: https://www.gate.com/trade/XRP_USDT

XRP recently broke through the critical $3.50 resistance level, forming a textbook bull flag pattern and signaling potential for a strong rally. Technical analysis indicates the pattern could push prices to $15—more than a 400% move from current levels.

The debut of Grayscale XRP Trust and REX-Osprey XRP ETF has further fueled institutional interest, driving momentum across the market. These catalysts could result in significant price appreciation for XRP in the coming months.

Technical Analysis: Bull Flag Points to Strong Upside Potential

Technical analysts report that XRP’s current price action is displaying a classic bull flag—a pattern typically emerging after strong rallies, suggesting continued upward movement following brief consolidation. The decisive break above $3.50 confirms the bullish outlook.

Based on standard pattern projections, XRP could reach $5.80 or higher within the next few months. If momentum continues, achieving the $15 price target remains a possibility.

Market Drivers: Institutional Interest Accelerates

Institutional demand for XRP is climbing sharply. Grayscale XRP Trust and REX-Osprey XRP ETF offer streamlined access for large investors, resulting in substantial inflows of capital. These new products represent XRP's integration into mainstream finance, further supporting price appreciation.

Ripple’s expansion into decentralized finance (DeFi) also contributes to growing market confidence in XRP’s future outlook. Partnerships with leading financial institutions further strengthen this confidence.

Investor Focus: Key Support Levels & Risk Considerations

Despite strong market sentiment, investors should monitor these crucial support zones:

- $3.50: Former resistance, now acting as support.

- $2.80: A drop below this level may signal near-term downside risk.

It is also important to monitor broader macro factors such as global market volatility. Changes in regulatory frameworks could significantly affect XRP’s price trajectory.

Conclusion: XRP’s Upside Potential Remains Strong—Exercise Caution

Technical indicators and market trends point to robust upside for XRP. Analysts generally offer a bullish consensus. Investors seeking higher returns should remain vigilant regarding potential risks and market fluctuations.

If you want to capture value in digital assets, XRP is a compelling option. Conduct thorough market analysis and manage risk actively before making allocation decisions.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality